Accidents and losses are inevitable in life, and the extent to which these losses affect us and our loved ones varies. Insurance somewhat lessens the impact by providing financial benefits for covered losses.

An insurance policy is a safety net to protect you to some extent from the risks of daily life. The risks can be as drastic as floods, fires, car accidents, and life-threatening illnesses. You can’t stop accidents from happening, but a reliable insurance policy can offer you financial coverage for these unexpected expenses.

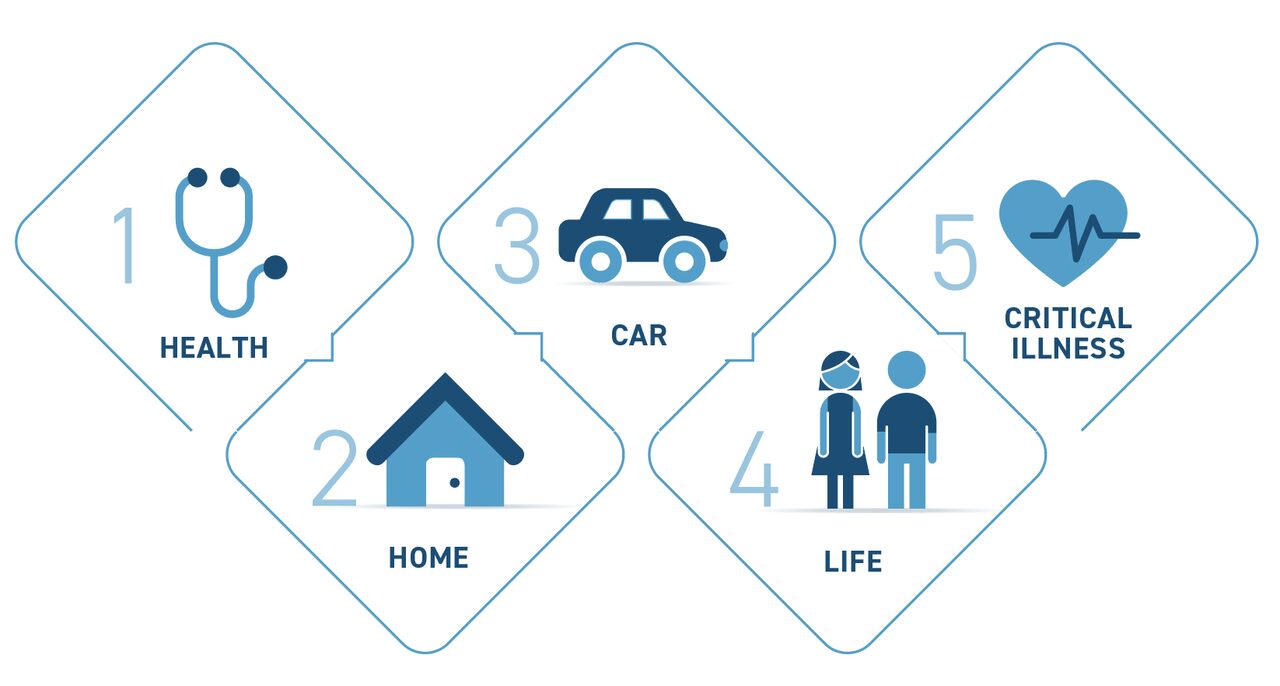

Protecting your valuable assets is a crucial basis for creating a solid personal finance plan, and the right insurance policy will help you protect your earning power and assets. Today, we discuss five policies you shouldn’t avoid.

The prospect of long-term disability (LTD) is so terrifying that most people choose to ignore it. While we all like to think that “nothing will happen to me,” relying on good luck to protect your future earning power is not a good idea.

Instead, choose an insurance policy that offers enough coverage to enable you to enjoy some version of your current lifestyle even if you can no longer continue earning.

Long-term disability offers a monetary benefit equal to a percentage, usually 50% or 60% of the insured’s salary for covered disabilities. Long-term disability usually starts when short-term disability ends.

For the insured to be eligible for benefits, the disability must have happened after the policy’s issuance. Most insurance companies also apply a waiting period after which the insured is eligible for insurance.

Medical information, often confirmed by a physician, is needed by the insurer for consideration. Most long-term disability insurance policies categorize disabilities under own occupation or any occupation.

Own occupation means the insured cannot perform their regular or similar jobs due to disability. Any occupation means the insured is unable to perform any job for which they are qualified due to their disability.

This insurance is similar to short and long-term disability insurance and workers’ compensation. It pays a financial benefit to workers who are injured or disabled at work or while performing their jobs.

While both long-term disability insurance and workers’ compensation insurance pay for disabilities, long-term disability insurance is not restricted to disabilities or injuries that happen at work or while working.

Life insurance protects the people who are financially dependent on you. If dependents like your parents, partner, children, or other loved ones will face financial difficulties if you died, life insurance should be high on your list of things to do.

Assess how much you earn each year (and the number of years you plan to remain employed) and get a policy that would be able to replace that income in the event of your early demise. Factor in the cost of burial, too, as the unexpected cost is a burden for many grieving families.

The increasing cost of medical care is a cause enough to make health insurance an essential need. Even a regular visit to the family doctor can result in a hefty bill.

More severe injuries or illnesses that result in a hospital stay can result in a bill that is more than the cost of a one-week stay at a foreign luxury resort.

Injuries that need surgery can quickly raise up a six-figure bill. Although health insurance costs are a financial burden for everyone, the potential cost of not having coverage is much higher.

Replacing your home is an expensive proposition. Having the right home insurance can make the process less complicated. When shopping for a policy, look for one that covers replacing the structure and the furnishings. It should also cover living somewhere else while your home is repaired or rebuilt.

Remember that the cost of rebuilding doesn’t need to include the price of the land since you are already its owner. Depending on the age of your house and the facilities it contains, the cost to replace it could be more or less than the price you paid for it.

To get an accurate estimate, find out what local builders are charging per square foot and multiply that number by the area you will need to repair in your house. Don’t forget to factor in the cost of upgrades and special features.

Also, make sure that the policy covers the costs of any liability for injuries that might occur on your property.

Some form of automobile insurance is required by law in Pakistan. Even if you are not required to have it, and you are driving an older car that has been paid off, car insurance is something you shouldn’t skip.

If you are involved in a road accident and someone is injured, or their car is damaged, you may be subject to costs that could severely set you back financially.

Accidents happen quickly, and the results can be tragic. Having no car insurance or purchasing only the minimum required coverage like third party insurance saves you only a tiny amount of money and puts everything else you own at risk.

It is best to have a comprehensive insurance policy in place.

Insurance policies come in different shapes and sizes and offer many different features, benefits, and prices. You should shop around carefully, read the policy documents, and talk to a certified insurance representative to be sure that you understand items covered and the cost.

Make sure the policies you purchase are adequate for your needs, and don’t sign on the dotted line until you are happy with the purchase.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.

This post was last modified on March 5, 2024 2:18 pm

Originally a conceptual option, telemedicine became indispensable during the pandemic, and has reshaped how people…

Health insurance is a financial management tool that helps reduce the amount people will pay…

A health insurance policy provides financial protection against medical expenses, however, most insurance policies have…

As 2025 starts of, Pakistan’s insurance industry is experiencing significant transformation. From technological advancements to…

Life is full of twists, and though most people plan for the future, most of…

Who do you think needs life insurance the most? Traditionally, the answer was men, as…