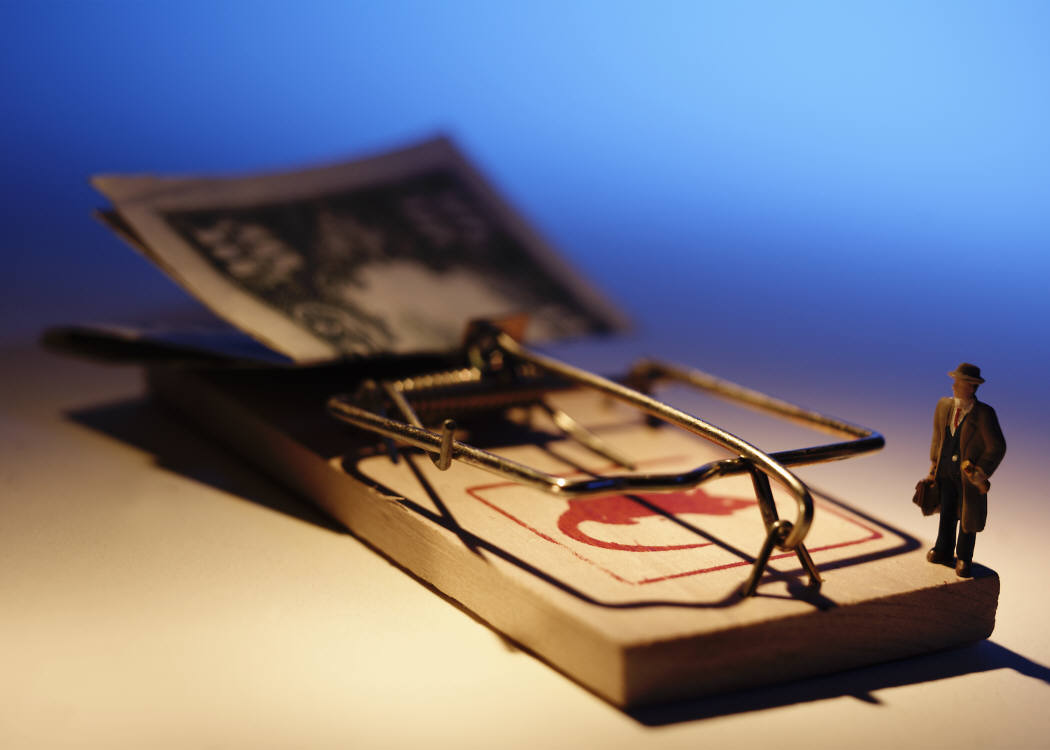

Since the inception of the internet, each year ends up leaving thousands of people with loss of millions due to scams. The advancement in digital communication has opened doors for evils to do scams that are hard to identify at first place. However, the goods are also doing their best to let a layperson understand and evaluate the scams, before becoming a victim to them. However, if you are the one who is not familiar with the term investment scheme scam or any other such theft factor, we have compiled a comprehensive guide about investment scheme scams to help you identify the potential triggers and signals to play safe.

An investment scam is a term used for the act where the innocent people are robbed. Apparently, these people look really innocent, harmless and sincere and have deep knowledge of marketing materials and websites etc. One of the most common types of investment scam is where many people are asked to contribute into a project as an investor and after some time the scheme is showed to be failed to result in loss of all the money paid by the investors.

The enhanced patterns of digital communications have made the investment scams a bit more complex. Some of these investment scams look so real and convincing that you can find even a professional investor falling for them. The older people are found to be more on the top list of being the target of such scams. These people have lesser idea about the technological advancements and the possible threats due to it. The ideas may vary but all the investment scams have one thing in common- they claim to offer a higher level of returns on smaller investments.

With the passage of time, the crime has modified itself and you can find scammer running comprehensive website infrastructures with a convincing digital presence. This presence helps them look real and reliable to their victims. Thus before investing into any business or investment idea that is offered over the internet, check if the company is registered with the government authorities and do they have a valid registration with the legal authorities of the state or not.

Other hints that can be a warning sign about the scam of the offered business idea can be;

The Cold Calling: Such scammers generally call you without any reference and show themselves as a stockbroker or a project manager. They tend to offer you an investment plan that can give you a higher return on investment and avoid mentioning any kind of risk. They will also try to convince you that the risk level is very low. They may also provoke you to invest in international companies or they will sound too much polite and friendly to even a harsh attitude. You may also find them consistent as they will keep calling you, back and forth.

Promotions & Tips: Such scammer will also encourage you to buy shares in company or stocks. They will also show their confidence in predicting an increase in shares in coming time. It is possible that they will contact you via email or a phone call to your local number of a cell phone. Such scammers are actually trying to boost the stock price so that they can sell their shares and make some considerable profit. Once you are done with buying such shares, the value will dramatically go down. In case of any such investment, you will be left with a huge loss as such shares are actually worthless.

The Investment Seminars: The investment seminars are generally promoted by motivational speakers, self-made millionaires or the investment experts. These seminars are meant to give advice on investment plans and the benefits associated with them. Such seminars and motivational lectures are designed to convince people for taking part in high-risk investments. This may include borrowing a large amount of money for buying property or investing in lending money with no security of return etc.

The promoters of such seminars make money by charging the attendants with a big amount of attendance fee or by selling overpriced books or reports, or by pushing you to buy property without any expert opinion. Such offers for investments are commonly overvalued and many end up having you pay commission and fees that are not clearly mentioned by the promoters. These are sale tricks that are misleading and led by false claims that pressurize you to invest in the idea. There are higher chances that investing it in such plans will lead you to loss of money.

Retirement Funds: These plans are designed to make you believe that you can access your retirement funds before time. They are mostly designed with the core idea of self-management of funds or for a fee. Such offers generally come from a scammer who pretends to be a financial advisor. The scammer will ask you believe on the story that you will get your retirement funds early than the designated time frame. Later, acting as your financial advisor these scammers will approach the company who is supposed to pay your retirement fund and will take away all the money with them, leaving you with nothing but regret. Or in another case, they will take a large amount of the funds as their fee and leave you with merely a small amount of what you actually own.

You must know that you cannot access the retirement fund until you reach the mentioned age limit. There are some exceptions to the matter like extreme financial issues etc. else than that, there is nothing that can lead you to early access to the funds, before time.

Here is a quick list of simple and easy to understand signs to find out if the approach is any kind of investment scam or not;

You can protect yourself from such scams by considering the following piece of advice;

This post was last modified on July 3, 2018 5:21 pm

Health insurance is a financial management tool that helps reduce the amount people will pay…

A health insurance policy provides financial protection against medical expenses, however, most insurance policies have…

As 2025 starts of, Pakistan’s insurance industry is experiencing significant transformation. From technological advancements to…

Life is full of twists, and though most people plan for the future, most of…

Who do you think needs life insurance the most? Traditionally, the answer was men, as…

What do you do if a sudden event wipes out a family’s savings or pushes…