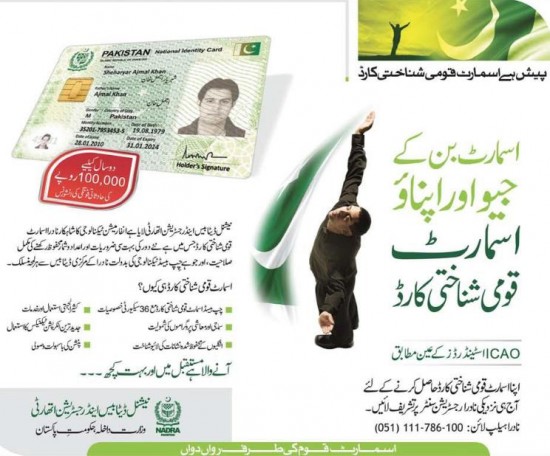

Remember the chip based identity card NADRA launched a couple of years back? It became the talk of the town for its added benefits, security features and multidimensional usage. However the biggest factors that majority of people would consider were pension disbursement and accidental death insurance worth PKR 100,000. This was hailed as a great move to support the families with monetary cover in case of death.

However to people’s dismay, the accidental death insurance benefit of the Smart Card has been terminated just after a little over a couple of years after its launch in January 2013.

According to inside sources, the insurance claims were paid during the initial two years of the scheme’s introduction. However now no new claims are being entertained. The reason for discontinuation of this facility is due to the agreement between NADRA and State Life Insurance Company was due to be renewed after 2 years has now expired and NADRA’s present management has failed to pay the premium for continuing the scheme to the insurance company.

The agreement was penned in October 2012 by SLIC chairman Aziz Siddiqui and NADRA chairman Tariq Malik, which enabled SNIC holders to be automatically entitled to an insurance cover of PKR 100,000 for a period of 2 years. The holders could designate nominees at the time of this registration, who could collect the insurance amount at the time of their death.

There is no comment from NADRA representatives yet on this matter. Smart Card holders however are disappointed as this insurance cover was deemed as a blessing for many families to provide some kind of relief at the time of demise. We hope that NADRA can somehow restart this initiative to facilitate smart card holders as promised earlier.

This post was last modified on August 24, 2017 11:11 pm

Health insurance is a financial management tool that helps reduce the amount people will pay…

A health insurance policy provides financial protection against medical expenses, however, most insurance policies have…

As 2025 starts of, Pakistan’s insurance industry is experiencing significant transformation. From technological advancements to…

Life is full of twists, and though most people plan for the future, most of…

Who do you think needs life insurance the most? Traditionally, the answer was men, as…

What do you do if a sudden event wipes out a family’s savings or pushes…