Navigating family health insurance can be complicated and time-consuming, but finding the right health insurance plan doesn’t always have to be stressful. We have some valuable tips and tricks to help you compare multiple family health insurance plans and pick one that’s best for you and your loved ones.

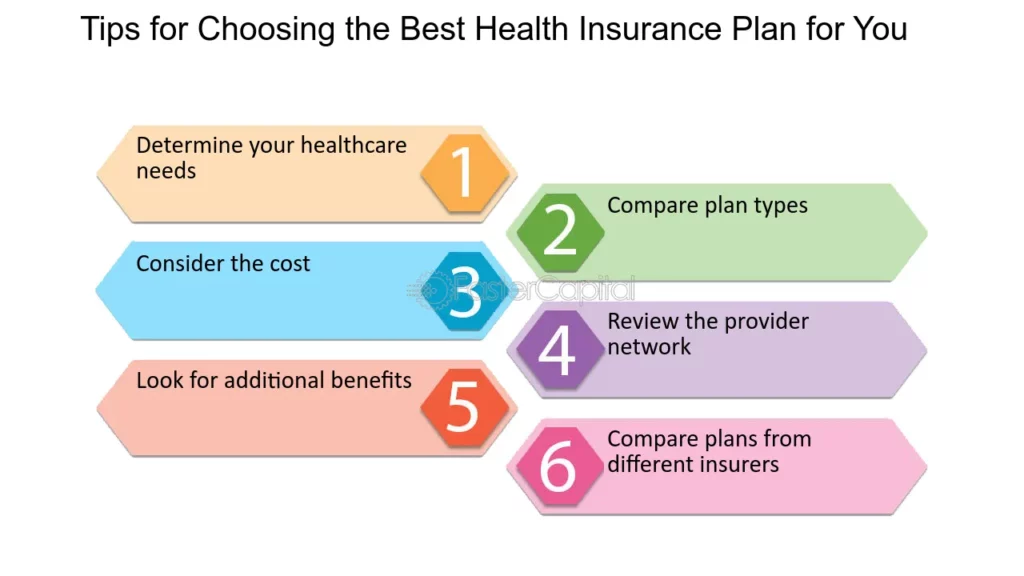

Know What You Need

Before getting into the finer details of insurance plans, take some time to assess your family’s specific needs. Think about:

- Medical History: Are there any long term health conditions or regular medications needed?

- Doctor Visits: How often do family members need to visit the doctor on a regular basis?

- Preferred Doctors and Hospitals: Do you have specific healthcare services or providers you need to keep seeing?

- Family Size and Age: Younger families might prioritize pediatric care, while older families might focus more on chronic condition management.

Learn the Insurance Jargon

Health insurance has its own unique terms and phrases. Take some time to get to know important terms such as:

- Premium: The amount you pay monthly for the insurance plan.

- Deductible: The amount you pay out of pocket before your insurance starts covering costs.

- Copayment (Copay): This is a fixed sum you pay for a covered healthcare service.

- Coinsurance: The percentage of costs you pay after meeting your deductible.

- Out of Pocket Maximum: The maximum amount you’ll pay in a year, after which the insurance covers 100% of costs.

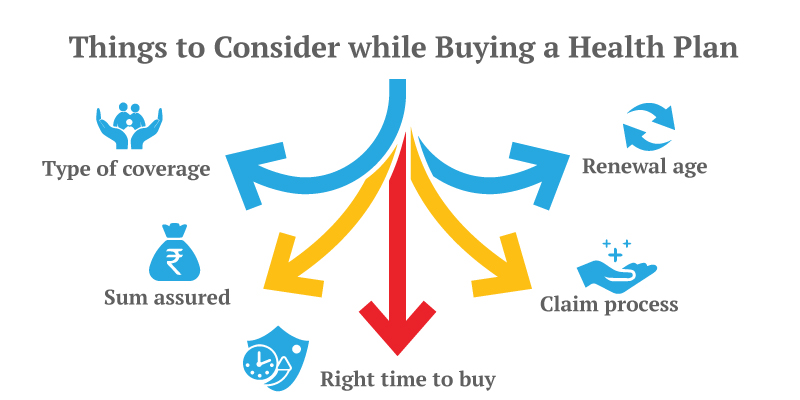

Compare Health Coverage Options

Not all plans cover the same services. Look at what is included and if you really need it:

- Preventive Care: Check if routine checkups, vaccinations, and screenings are covered.

- Specialist Visits: Ensure that visits to specialists, like dermatologists or cardiologists, are covered.

- Emergency Services: Verify coverage for emergency room visits and hospital stays.

- Prescription Drugs: Review the list of covered medications, especially if your family needs specific prescriptions.

See if Your Preferred Network Providers are Included

Insurance plans include networks of healthcare providers like doctors and hospitals. Check that your preferred providers are in the network to avoid inconvenience and increased expenses.

In Network: Lower out of pocket costs when using these providers.

Out of Network: Higher costs and sometimes no coverage at all.

Consider Costs Beyond Premiums

While a low monthly premium is attractive, it’s essential to look at the bigger picture:

- Deductibles and Copays: Higher deductibles can mean lower premiums but higher out of pocket costs at the time you need care.

- Out of Pocket Maximums: Plans with lower out-of-pocket maximums can protect you from excessive expenses in case of severe illness or injury.

Find Plans that Offer Additional Perks

Some plans offer benefits beyond basic healthcare, so take care to pick plans that offer perks that match your needs:

- Telemedicine: Virtual doctor visits can be convenient and cost effective.

- Wellness Programs: Discounts or incentives for healthy living, such as gym memberships or smoking cessation programs, can be a helpful benefit.

- Mental Health Services: Access to counseling or therapy can be invaluable.

Check Reviews and Feedback

Sometimes, the best insights come from those who have used these plans before you. Read reviews of different plans and ask friends or family members about their experiences with a specific company.

Use Online Comparison Tools

Many websites offer tools to compare insurance plans side by side. These tools can help you see differences in coverage, costs, and benefits at a glance.

Review and Reevaluate Annually

Your family’s needs and the health insurance market can change. Make it a practice to review your plan annually and adjust terms and coverage as necessary.

Deciding on the perfect family health insurance plan is a significant step. With these helpful tips, you’re on track to selecting wisely for your family’s health and happiness. Just keep in mind to pick a plan that suits your specific requirements and brings you peace of mind. Have fun comparing your options!

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.