In our ever-changing world, where unforeseen events can unexpectedly impact our financial stability, it is vital to prioritize the safeguarding of financial security for all individuals.

Microinsurance is an incredibly beneficial and innovative financial tool that provides a crucial safety net for individuals with limited financial resources. It is specifically tailored to meet the needs of low-income individuals who are frequently overlooked by traditional insurance providers. This form of insurance plays a vital role in ensuring that everyone, regardless of their economic status, has access to essential financial protection.

According to the World Bank, over two billion people lack formal social security. Such people are the most exposed to risks and economic stress. Micro-insurance helps to protect low-income groups against specific perils in exchange for regular monetary payments (premiums) equivalent to the likelihood and cost of the risk involved.

Understanding Microinsurance

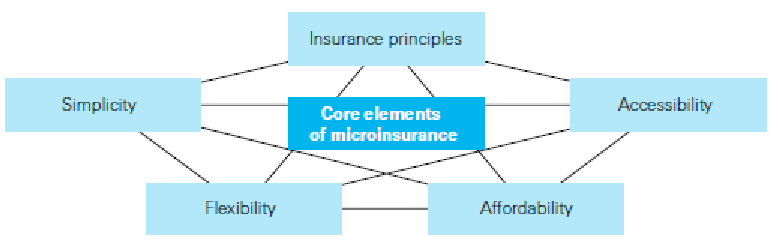

Microinsurance, a financial product tailored to the insurance needs of low-income individuals and families, stands out for its unique features. Unlike traditional insurance policies, which can be complex and costly, microinsurance policies are designed to be affordable, accessible, and straightforward.

These policies typically cover a range of risks, including health, life, property, and agricultural insurance, offering a safety net for those most vulnerable to economic shocks.

Key Features of Microinsurance

1. Affordability: Microinsurance policies are specifically designed with affordable premiums that are set at a level accessible to low-income individuals. This approach ensures that financial constraints do not hinder people from obtaining insurance coverage.

2. Accessibility: Microinsurance products are often distributed through easy-to-access channels such as mobile phones, community organizations, and microfinance institutions, making them accessible to people in remote or underserved areas.

3. Simplified Coverage: Policies are designed to be easy to understand, with straightforward terms and conditions. This makes such policies easier to trust and encourages uptake among potential policyholders.

4. Community-Based Approaches: Local knowledge and networks are integral to effectively distributing and managing microinsurance schemes, which are primarily community-based.

These schemes leverage the understanding of local conditions to tailor policies that meet the community’s specific needs. Additionally, the networks within the community are utilized to ensure efficient administration and distribution of insurance coverage.

Benefits of Microinsurance

Microinsurance benefits individuals, families, and communities, contributing to broader financial stability and inclusion.

Financial Protection

Microinsurance offers invaluable financial protection to low-income families. In the unfortunate event of unexpected illness, death, natural disaster, or other adverse events, microinsurance provides coverage for associated costs, ensuring that these families are shielded from falling deeper into poverty due to unforeseen expenses.

Economic Stability

Microinsurance helps stabilize the economy by reducing financial risks. When individuals and families are protected from financial shocks, they are more likely to invest in education, health, and income-generating activities. This can lead to better economic outcomes and an improved quality of life.

Empowerment and Confidence

Microinsurance coverage does more than provide financial protection. It also gives people a sense of security and confidence. This support enables them to take calculated risks and pursue opportunities they might otherwise avoid because they fear financial loss.

Promoting Financial Inclusion

Microinsurance is important for helping low-income individuals join the formal financial system. It provides insurance to people who are usually not able to get it. This helps them access other financial services like savings and credit, which can help them improve their economic opportunities.

Challenges and Solutions in Microinsurance

Despite its potential benefits, microinsurance faces several challenges that must be addressed to maximize its impact.

Awareness and Education

Many low-income people don’t know much about insurance or the benefits it provides. To get more people to buy microinsurance, we need to educate them. Campaigns that fit with the culture and language of the people being focused on.

Distribution and Reach

Reaching remote and underserved populations can be a difficult process because of infrastructural and logistical difficulties. Innovative ways of delivering services, like using mobile technology and working with local organizations, can help solve this problem.

For example, mobile-based insurance platforms allow people to buy and manage insurance using their phones, making it accessible even in places with limited physical infrastructure.

Affordability and Sustainability

Microinsurance needs to be affordable while ensuring financial stability. To do this, insurers should manage risks effectively, use technology to lower administrative costs, and consider options like subsidies or partnerships with governments and non-governmental organizations to help economically vulnerable communities pay their premiums.

Trust and Transparency

The success of microinsurance hinges on establishing and maintaining trust and transparency. Insurance providers must make customer service a top priority and guarantee swift and equitable claim processing. This approach is essential for fostering credibility and instilling confidence in the product, particularly within low-income communities.

The Role of Technology in Microinsurance

Technology, particularly mobile technology, has played a transformative role in developing and distributing microinsurance products. It has revolutionized the way microinsurance is delivered, making it more accessible and efficient than ever before.

Mobile-Based Insurance Platforms

Mobile-based platforms enable individuals to purchase, manage, and claim insurance policies using their mobile phones. This approach is particularly effective in regions with high mobile phone penetration but limited access to traditional banking and insurance services.

Data Analytics and Risk Assessment

Advanced data analytics can enhance risk assessment and pricing accuracy for microinsurance products. By analyzing data from various sources, insurers can better understand low-income populations’ risks and tailor their products accordingly. This can result in more customized pricing and better risk management.

Blockchain for Transparency

Blockchain technology is a game-changer in microinsurance. It enhances transparency and trust by providing a secure and immutable record of transactions, ensuring that policyholders receive their benefits promptly and fairly.

Conclusion

Microinsurance is a powerful tool for promoting financial safety and inclusion for all. By providing affordable, accessible, and straightforward insurance products, microinsurance helps protect low-income individuals and families from financial shocks, contributing to economic stability and empowerment. While challenges remain, innovative solutions and the strategic use of technology can help overcome these barriers and unlock the full potential of microinsurance. As we strive for financial safety for all, microinsurance will play a vital role in building a more resilient and inclusive financial system.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.