I think it’s interesting how someone’s habits change from when they’re building wealth to when they have it. It is very common that when you’re building capital, you typically have pretty rigorous rules in place to follow, be on your toes constantly to help you get to where you want to be. But as soon as people have the money they are working for, it’s time to break for them to get rid of all of those good, well-established habits and show off and spend their money. Those activities can at the end of the day reverse all the work and effort you’ve done and cause all of the wealth you’ve built to seemingly vanish and lose overnight.

It’s a lot easier to lose or use all the money than it is to gain/make it or earn it. Here are three of the easiest ways to become poverty-stricken in a year (or less). By learning about them, hopefully, you can evade them.

Buying Materialistic Things

One of the quickest ways to go broke is to spend money on money-oriented things, the things most people never need. Whether it’s designer clothes, flashy cars, or anything in between. When people feel like they’ve ‘made it,’ to a point where their hard work has paid off, they get the sense or the feeling that they have to show everyone about it “more off announce it to the world”. Which repeatedly goes against how they got to “earned” where they are in the first place.

While somebody is working hard and creating fortune, they don’t spend money on things while they are working towards it. But at that juncture, all of a sudden, when someone has wealth, the money they have worked so hard to earn, a switch flips, and it seems like a good idea to break all of their good habits and routine, and instead of continuing to build wealth, they blow their money disproportionately.

From: look at all of the money I have, to look at all of the money I had. The transition is pretty danm fast and smooth without any hiccups and the fastest way to crash the fortune and wealth just earned.

You often hear about news and it comes as a shock when professional athletes or celebrities go broke. When people start creating wealth, they lose their sense of reason and sense of why they were working so hard and spend it all, usually on stuff that doesn’t matter nor is needed. That’s why structuring good habits early on is significant.

When it comes to material things, no one recollects what they wore a month ago, let alone a few years ago. So no one does or will remember what outfits, or watches, or expensive things you had in the past either. So we wouldn’t focus on that, honestly, no one who truly cares about you cares about your ‘things.’

Not Thinking About Your Future Self

With money when in hand all hard and new, fresh out of the bank, begging to be spent, especially the newly earned money, a lot of people get the impression or feeling that it will go on forever, that they don’t need to worry about things common people worry about. Things like making financial arrangements, setting up an emergency fund, saving, and investing for their future.

That causes people to be underprepared and leaves them exposed to a lot of risks. When an individual has created wealth, there are things that can happen or occur that would deplete the hard-earned. Things like being unable to work or unexpected death.

On the other hand, some people just don’t think much about the future, a very common phrase “Aj hai kal nahi” “aj jeee lo” as very famously Shah Rukh khan said “ kiya pata kal ho na ho” the yolo mentality. Causing people not to put things in perspective or think big picture and think about what’s in the future. Good financial health is to perform a balancing act of living a happy lifestyle today while looking out for your future self. You want to do things that your future self will look back on and thank you for.

I believe 100% that everyone should do what makes them happy. Otherwise, life is not really worth it. But again, it’s a balancing act. Spending everything today and having nothing for tomorrow doesn’t make sense, and neither does having nothing now while saving everything for tomorrow.

Think about an individual who bought a BMW 750i back in 2011 and wants to change it in 2014. The car’s proposed retail price was 15000,000 three years ago, but the same vehicle would sell for about 75000,000 today, according to an online source. That’s a 75000,000 net cost over three years or just almost 200000 per year. If this person had purchased a Honda Accord in 2011 instead of the pricier BMW, he would still have faced a depreciation on the vehicle, but he’d do that at a significantly lower cost.

Specifically, the Accord that cost PKR 55000,000 new in 2011 could be sold for about half three years later. The annual cost of ownership works out to PKR 800,000, so the other person has more to save and invest each year than the owner of the BMW. That may not make him look stylish, but it does make him look smart.

Live paycheck-to-paycheck

The surveys have shown that virtually anyone who lives above the line of poverty has the ability to save only PKR 2500 a week. According to a report, 28 per cent of the population has categorically no emergency fund, according to Bankrate.com. That means they’re wavering on the edge of bankruptcy, just petitionary to be sent over the edge by an unanticipated expenditure, such as a car repair, health crisis or job loss.

Play the lottery

A lottery is a game of luck! In hundreds and thousands of people, one individual wins! Somebody’s got to win, so why not you, right? Regrettably, the chance of your winning is worse than your chance of getting crushed by a vending machine or becoming a movie star, according to the source Daily Beast. Indeed, gambling of any kind used by anyone is a recipe that means losing a proposition. According to a Wall Street Journal investigation, 95 per cent of gamblers lose in the end, leading to loss of great funds.

Buy on credit

There’s nothing that can make you poorer than paying interest on purchases that you made years ago but can’t pay off. Consider: If you have a $5,000 balance on a credit card charging 19 per cent per annum and pay $100 a month against the loan, you’ll spend 100 months paying off the bill and end up paying a total of $10,000 5000,000 in principal and $5,000 in interest. If you don’t want to be poor, don’t buy things before you can afford to pay for them with cash.

Be a victim

There is a whole spectrum of the mindset of “The victim mentality” that involves blaming others for whatever goes wrong, but it’s really a way to rationalize and streamline making and continuing to make bad decisions, Finley a financial analyst said. If someone wants to be rich in the future, he/she needs to understand and take responsibility for what’s wrong in her financial life, learn from it and fix it.

Getting an Inheritance

Some people who become heir to money spend irrationally. They go on shopping extravaganzas, take vacations and immediately start upgrading their lifestyles. We have seen people want to buy everything from cruisers to manors that are completely out of budget after receiving an inheritance. Usually, there’s going to be a huge rush of emotions to spend it when you suddenly have money but those are your worst enemy.

Unable to separate rational thought from short-term choices that’s how to go penniless.

Entrepreneur Syndrome

Many financially successful people go bankrupt trying to get richer. They start companies they don’t need and don’t have the experience to run. Washington Post columnist Michelle Singletary called it “entrepreneur syndrome.” In an article, she mentioned NFL player Warren Sapp as an example of this. His bankruptcy filing, submitted in March 2012, listed $6.5 million in assets and $6.7 million in liabilities. His lawyer told the newspaper that Sapp filed because of his business sum was unpaid.

Going To Jail

Going to jail definitely leaves people poor. Home loans, cars loans, child support and other obligations don’t pay themselves, but you still have a loan from. And that remaining and mounting debt can cause a person to lose everything. It’s nifty to make a financial plan before you go and perhaps even file economic failure to give yourself a clean start when you get out, otherwise, you can end up going to financial jail for longer than real jail.

Bad Business Partners

Choosing a bad business companion is a common reason people are ruined, according to Qualitative Research. One partner can run up credit, drain the business and essentially run it into the ground. When the unsuspicious partner discovers what’s going on, there’s no money and massive debt. Even if you were gullible or deceived, you’re responsible for what your partner does, she said.

Being a Cosigner

You may have a heart of gold and feel the passion to help your loved ones in need but in many cases, people go bankrupt cosigning for a family member or a friend. Once a woman in her 20s co-signed for her aunt’s loan. The aunt stopped repaying, and her niece was left to pay the loan, plus interest, to avoid ruining her credit at a young age.

Cosigning a loan might seem like a simple favour, but it can land you in some serious trouble

Over-Indulging Single Moms

Working single mom took a loan to take her child to her child to Disneyland with friends for his seventh birthday, another mom booked a weekend at a fancy hotel with room service to celebrate her child’s valediction from elementary school. And she put it all on a credit card.

A lot of single moms stick their necks out and do wild things to give their kids whatever they want, But since kids don’t have an end to what they want, these women end up broke. These moms are often driven by memories of their own underprivileged childhoods, so they over-indulge their children in their own jeopardy.

Inheritance Scams

It’s not uncommon to find people who lose everything because of advance-fee schemes. We saw once that one gentleman discharged his entire IRA trying to help someone in Nicaragua supposedly transfer an inheritance to the U.S. The victim transferred a couple of thousand dollars at a time for travel fees, bank fees and whatsoever the scammer asked. And, in return, he was theoretically to get repaid plus make a profit. Instead, he was broke and got nothing.

It was a little bit of greed and a little bit of trying to help someone out,” that actually took away all that he had.

Excessive Plastic Surgery

One thing that is becoming popular these days is to have a picture-perfect face and body!

Another star of “The Hills,” Heidi Montag, also ended up broke and living with Pratt’s parents, according to the Daily Beast interview. Unwarranted plastic surgery used up a lot of her money. Montag had three procedures within the first year of the show airing, and later she underwent 10 procedures in one day, according to The Daily Beast. This was one of the ways she overspent and became poverty-stricken.

Not Paying Back Taxes

People don’t usually pay back taxes for many reasons, ranging from honest mistakes and lost paperwork to willful ignorance and tax evasion. But if you’re deliberately dishonest, don’t stick to payment plans or ignore collection attempts, the FBR can take action that leaves you destitute, such as seizing your accounts and trimming your wages.

Living for Fun

During a 2010 appearance on “The View,” Mike Tyson said he was “completely broke” and “destitute.” This is a man who once had $300 million, lived in mansions and kept Siberian tigers as pets, The New York Times reported. When asked how the financial downfall happened, his reply was: “I had a lot of fun.”

Life is not just a ride on a roller coaster, one needs to evaluate and re-evaluate every now and then that what works or not? Are they doing things the right way? Are their house and work in order? Do they need to sit and plan is there a need to do so?

“Life cannot be all fun and no work”

Financially Tied To Your Car

A lot of people go broke because of their cars according to a report. He told a story about one man who was driving a BMW with a certain amount per month car payment, which he could barely afford. Add a couple hundred thousand in gas and the insurance, all-in he was basically paying hundreds and thousands a month for a car. It was more important to him than his house, so he downgraded where he lived to keep his car. In the end, that car destroyed his credit and left him bankrupt because he couldn’t keep up his lifestyle and keep the car.

One needs to understand the fine line between wanting to do something or they want to get something or when that person is over-stretching himself and the budget set for the month.

Ignoring Professional Advice

When your pipes need work, you call a plumber. When your car needs work, you call a mechanic. But when it comes to money, a lot of people don’t call a financial professional or they call them but ignore the advice and they end up broke, it’s something people think they don’t need an expert for.

According to a case study “A client came in in 2008, he had $1.1 million in the bank,” he said. “ the financial consultant offered him some options, but he decided to continue handling the money his way. He came back in 2010, and only had $680,000 basically enough to last seven more years at the rate he’d been spending. He was in trouble, and he knew it.”

Don’t wait too long, if you wait too long the situation might be unsalvageable.

Having an Affair

Well, well

Cheating is not only bad for your emotional wellbeing and family it can also leave your bank accounts empty. Depending on how long the affair lasts, the person who is cheating might spend hundreds or thousands on dates, gifts, hotel rooms and even flights if it might come to that. Some people even pay their lover’s bills. The average affair lasts six months and costs a lot per month, Meanwhile, factor in a cost can be if you have a suspicious spouse or partner who starts forking over cash to investigate what’s going on a private investigator might be an added cost that would really start to add up. While all of this extra spending is occurring, there are still household obligations to cover. Infidelity is a prime example of how emotion-driven decisions make people go broke.

Living on Credit Cards

Using credit cards like free money is another way people go broke. People will get five or six credit cards with multiple six-figure limits, depending on the financial profile. They’ll feel like they have a lot of free money, and they start living the good life. But credit runs out and needs to be paid back, and that’s where the problems come in. Managing minimum payments often turns to juggle payments between the creditors that are the most persistent. Interest and finance charges start piling up, and the debt won’t go down. “A lot of people end up exhausted and file for bankruptcy,” she said.

Taking Predatory Loans

Hocking your car for cash or getting a payday loan can make a bad situation worse. To repay these high-interest loans in a single payment, the average title loan borrower gives up 50 per cent of the average gross monthly income, and the average payday loan will consume 36 per cent of the average borrower’s paycheck, according to The Pew Charitable Trusts. A lot of borrowers can’t afford that, so they get caught in a cycle of renewing these loans, which digs a deeper and deeper ditch.

Overspending On Pets

The Sherman Law Group in Roswell, Ga., featured a question from someone who had over 43 pets at one point, including dogs, cats, birds, snakes, goats, horses and mice. Trying to pay the animals’ veterinary bills left the person struggling to pay for food, mortgage and car payments. The law group responded that they have had several clients who’ve gone broke from pet costs, but that such debts could likely be discharged in bankruptcy.

If you are doing everything all alone!

Overwhelming Medical Bills

Medical bills wreak havoc on people’s finances, especially those who have chronic and debilitating conditions. Many people who are overwhelmed by their medical debt run through their savings, turn to credit and take out loans trying to manage their households and health care. Despite their efforts, they might still end up broke. A poll conducted by NPR asked people how health care costs had impacted their finances. Twenty-seven per cent reported being unable to cover basic necessities, such as food, heat or housing, and 7 per cent had filed bankruptcy.

Not Having Savings

If a 40,000 emergency popped up, 46 per cent of people would struggle to pay for it, according to a recent survey by the Federal Reserve. And, a recent survey found that more than 50% of the population has less than 100,000 in savings. A lot of people live on the brink of financial disaster, having little or no savings. So it only takes one unexpected expense, such as a major car repair or leaky roof, to push them over the edge.

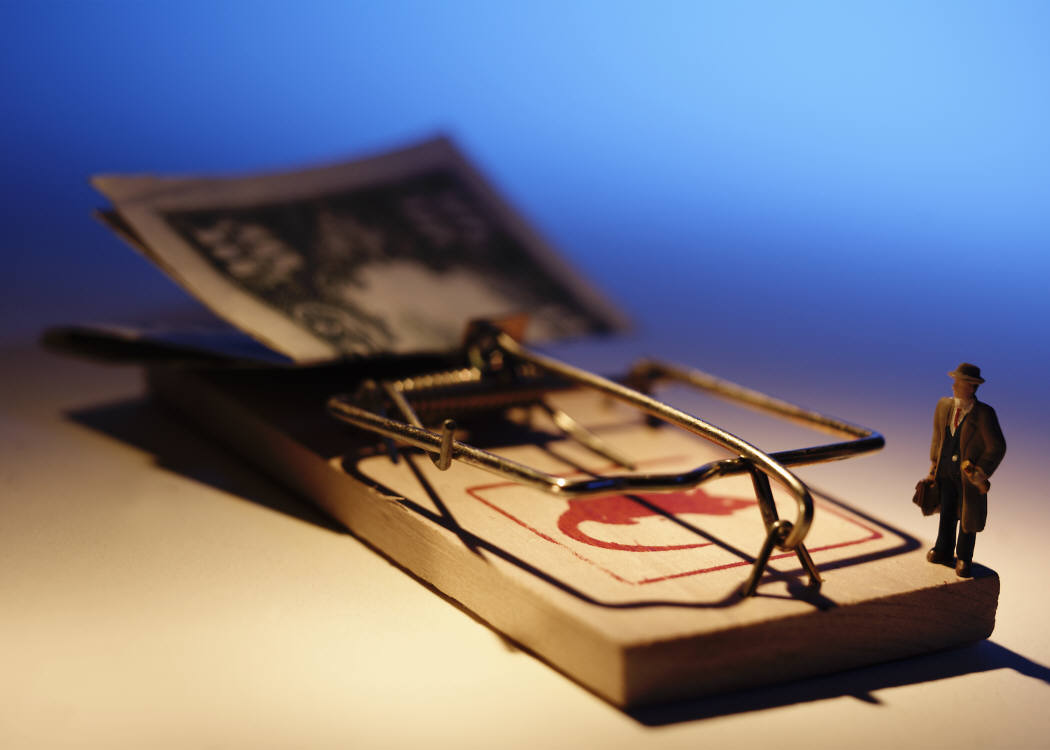

Conclusion

Getting rich is pretty easy. But many common money traps can just as easily make you poor, says Mike Finley, author of “Financial Happine$$.” If you’re wondering why you’re never getting ahead, take a look at these five traps and see if you’re snared by one or more of them.

Focus on looking good: It’s one thing to be in shape and well-groomed, quite another to wear the latest designer clothes and shoes and drive in late-model luxury cars. The thing about clothing and cars is that they’re depreciating assets. The moment you buy them, they’re used and worth significantly less than what you paid. If you pay up for labels and shop till you drop, the value of your “investment” in looking good looks worse and worse.

This article is for informational purposes only. Not all information will be accurate. This should not be considered Financial or Legal Advice. Consult a financial professional before making any major financial decisions.