There is a common principle of investing that claims that the best investments are those done when the markets are dropping, and everything is in the red. The basic principle is that the time for making good investments is when all investors are rushing to sell and there is a low demand for stocks.

In simple market terms, when everyone is selling, stock prices fall due to excess supply and low demand. This makes it a great time to buy as we can pick up great bargains. This advice is difficult to follow as very few investors follow this strategy of buying when the market is crashing.

Why Invest In Falling Markets

Most share investors follow a herd mentality when investing in stock markets. They invest where everyone is investing (and usually buy shares are higher prices). When markets are in a decline, many investors panic and start to sell off their shares. This generally pushes the prices further towards decline, and more investors start to sell.

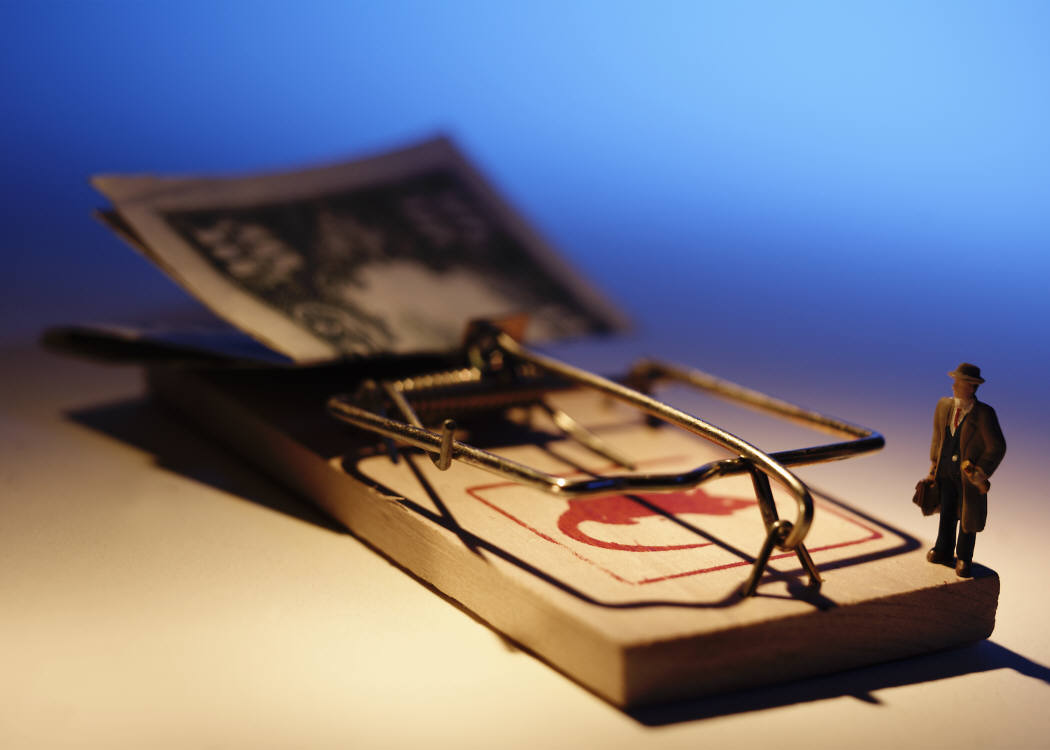

The thing to do, and what many successful investors do is to go sale shopping. Many investment gurus claim to pick up their best investments during market crashes. However, the average investor with a limited investment budget and an even smaller capacity to absorb risk is scared to do this. This hesitation is due to a fear that prices will fall further, and the trade will prove to be a loss.

The challenge for anyone that wants to invest in stocks is to time their purchase and do so successfully. A strategy of waiting for prices to reach rock bottom and then buying is not practical. A strategy to buy while prices are low is a better approach.

It takes a lot of nerve to invest when people around you are losing their investment values as prices fall. The main point here is to be realistic and pick up shares at bargain prices that you couldn’t earlier due to their high prices. Maybe you haven’t been able to buy your favorite blue chip stock because they were too pricey. If you buy them during dips, you get to invest in a performing stock, and at a bargain.

A clear example of such a situation will be that of a store owner, who didn’t stock luxury items because he didn’t have the space in his shop (and the capital to buy the items). In a pricing dip, he gets to pick up items at lower prices and has space freed up in his shop to stock the items since his cheaper goods are now sold.

Supply and Demand Principles

The basic rules of supply and demand economics state that low demand pushes prices down. When markets fall and investors panic. When panic induced selling starts, there is an excess supply of shares and a lack of demand.

This low demand pushes prices down, and the availability of stocks means that the price conscious investor can go bargain shopping and pick up stocks of their choice at low prices. Such markets make for good bargaining grounds and opportunities to pick up good stocks at low prices. Investing in markets when there are price dips allows for great bargains to boost portfolio returns.

Fighting the Herd Mentality

Falling markets always give rise to good bargains but few investors are alert enough to take them. The herd mentality is a difficult one to step away from, particularly when you see blood red on your trading screens. Trading against market trends is what allows investors to recuperate from any losses and earn profits by picking up good bargains.

Something that we need to remember as investors are that the markets always come back up. In fact, many investors feel that the deeper the fall, the higher the rise afterwards.

The key focus point here is to make sure that you do not end up buying high and selling low just because you panicked seeing all the red in your portfolio. Study the past crashes if you like and see how shares behaved.

If major crashes didn’t impact share prices and returns in the medium term, the regular dips and troughs of trading will not impact them either. Take all dips as opportunities and treat them as stock sales.

Make a List of Stocks to Buy During Dips

To be prepared for any significant market dips, have a bucket list of shares prepared. Someone I know prepares a list of shares that they want to get at specific prices. for instance, shares currently overpriced are selected and their buying prices listed so that if their prices fall, the investor is prepared to pick them up. Making this watchlist of shares that you want because of their returns, growth potential, or whatever criteria you use is an excellent cheat sheet during market falls.

It takes virtually no time to look up shares, recalculate their valuation, and see if they are worth investing in at their current prices. they can be picked up during the market downturn.

Another strategy investors use is to pick up more of their existing shares during market falls. Even if your shares are in the red, you picked them for a reason, and if there has been no change, you can increase your holdings by picking them up on the cheap. This helps to reduce your investment costs and improve returns when the market eventually picks up after the fall

Defending Your Existing Portfolio during Market Dips

The first thing to do in volatile or falling markets is to make sure that your current portfolio of shares is properly diversified between a variety of asset classes, and not just the stock market sectors.

Diversification helps to reduce the volatility that tends to rise during bear markets and can subject investor portfolios to unnerving fluctuations. Among shares, sectors that are insulated from market dips include companies dealing in consumer staples, utilities, banking and health care.

The goods and services these sectors supply tend to be in demand regardless of economic or market conditions. They also generate plenty of cash, which supports strong dividend yields.

An investor confident about a market’s impending rise could also buy the riskier stocks that tend to outperform in the early stages of the recovery. Of course, those are also the stocks likely to get savaged if the hoped-for bull market turns out to be another bear market rally.

The Bottom Line

Investing during a falling market is not for the faint-hearted, nor is it usually the right time to take outsized risks. And that’s just as true for the risk of selling all your stocks as the risk of being fully invested in equities. Diversifying one’s portfolio and prioritizing strong, well-capitalized balance sheets over hype when it comes to stock selection can pay off huge even if prompted by a bear market.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.