Many people who have insurance policies and are exploring their options are confused about the often used terms insurance deductible, co-payments, and coinsurance. What are these terms, and how are they different from each other? What do they mean when used in your insurance policy?

All these terms are a part of the medical bill you will be responsible for in case you are sick or injured. They represent the actual expense of an insurance holder. However, there are some specific differences between each of these terms, and we are here to help guide you toward understanding what each term means in your policy.

Understanding your actual medical costs and what expenses are acceptable (and not) is an essential part of managing your health care and insurance expenses.

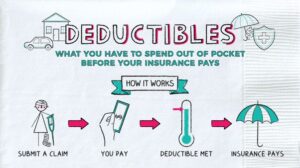

Deductible

A deductible is a set amount that a policy holder has to pay from his or her pocket before the insurance steps in to cover the remaining expenses. Based on your insurance plan, the deductible can start from PKR0 and go up to thousands of rupees.

In short, a deductible is an amount paid annually for covered medical services or medications before your health insurance starts to pay. For example, if you have a PKR15,000 yearly deductible and need a medical treatment (covered by your insurance policy) that will cost PKR 35,000, you will pay PKR15,000 of your total medical costs before your plan starts to pay.

A deductible can also be paid on a conditional basis per illness, injury, or insurance period.

As a rule of thumb, the premiums for an insurance policy decline as the deductibles increase. Since it becomes cheaper for the insurance company to issue a policy with higher deductibles, they charge the holder lower premiums. The opposite is also true. Lower deductibles mean higher premiums. However, don’t get carried away and opt for an insurance policy with high deductibles, as it does not usually pay off in the long run.

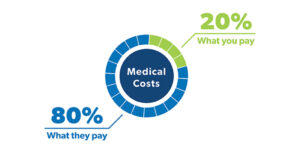

Coinsurance

Coinsurance is usually shown as a percentage and denotes the medical cost you must pay before your insurance plan starts contributing towards your eligible medical expenses.

Common coinsurance examples are 100%, 80/20, 90/10, and 50/50. This means that if you have 90/10 coinsurance on your insurance plan, the insurance company will pay 90% of your expenses, and you are liable to pay the other 10% on your own.

A deductible is often used with coinsurance rates. In such cases, you must pay the deductible amount first, and then you can receive the balance coinsurance amount.

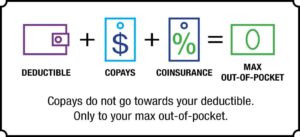

Copay (copayment)

A co-payment is a flat charge you pay on the spot each time you visit your doctor or buy medicines. For instance, if you hurt your knee and need to see your doctor or get a refill of your allergy medicine, the amount you pay for that visit or treatment is your copay amount.

Copayments are similar to deductibles, and they usually set a fixed amount of money the policy holder pays each time they use their insurance plan. However, they differ from deductibles in the sense that they are usually smaller amounts and are charged on a per visit basis. Copayment is paid on each trip to the hospital or doctor.

Difference between Deductible, Copayment, and Coinsurance

A health insurance deductible is a set amount a policy holder pays for their healthcare before the insurance policy starts to pay. Once the deductible’s limit is exhausted, users pay some fractional amount as a copayment or coinsurance for services covered by their healthcare policy, and the insurance company pays for the rest.

In most insurance plans, there is usually a combination of deductibles, coinsurance, and copayments. However, the insurance policy may not have any of them in some cases. It will depend on the individual insurance policy. This is why as policy shoppers and holders, we urge users to read their policy documents and be familiar with their policy details to know what their out-of-pocket expenses will be.

For more information about insurance terms and to help guide you further, please visit our blog

Insurance Terms and What They Mean to learn about more insurance terms to help you better understand your insurance policy.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.