Traditional insurance companies are not always the ideal examples of excellence in customer service. They have not always appreciated the value of customer centricity. Many companies even have an ‘us versus them’ approach towards clients that lacks transparency and creates conflicts between the company and its customers.

Such approaches as well as a lack of digital transformation, means some of the biggest names in insurance have a severe handicap in customer service compared to smaller insurtechs that are structured around the concept of customer service excellence.

What is Customer Centricity?

Customer centricity implies a frictionless experience, low-cost products, and better customer management. It is based on a fundamental business need to satisfy and delight your customers so much that they do not want to leave and praise you to others.

Being customer-centric means putting your customers first and guaranteeing that they get what they want or need when they want or need it. Those businesses who can do this successfully without sacrificing their profit will win.

The insurance industry is a little handicapped by the nature of the business. Offering ease of purchase and speed of transactions, while convenient, doesn’t leave companies with a lot of scope to build a rapport with their customers.

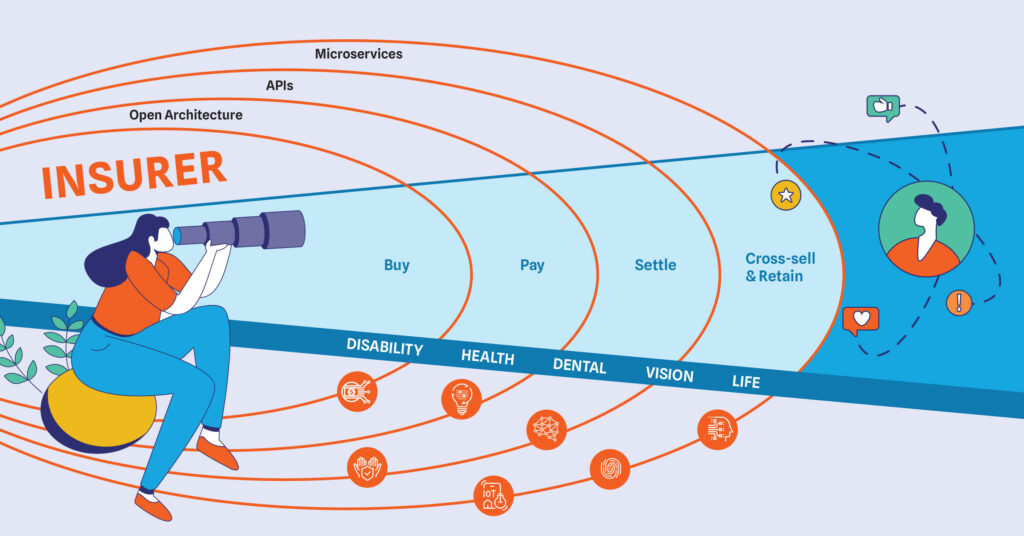

Insurance customers only interact with their agent or the company at purchase, renewal, or when they claim. This leaves both insurtechs and regular insurers with just two, or three, important chances to engage and impress their customers.

This is why many insurtechs focus on making the buying process as easy, simple, and efficient as possible to ensure that customers can assess the right products for their needs and transact easily.

Four Basic Customer-Centric Tactics

1. Anticipate Customer Needs

Taking customer requirements seriously and listening to staff on the front line about what customers appreciate the most or ask about, is a basic part of the anticipation process. AI technology and predictive analytics can be used to predict customer expectations too.

2. Get Feedback

Taking customer feedback is a key part of understanding their needs as well as highlighting processes that are working well versus those that aren’t. It also helps to use emails, chatbots, SMS, messenger apps, and direct phone calls.

3. Initiate Pilot Programs on New Products

Companies can launch their new products and services through the latest marketing tools. They can use cutting-edge marketing tools to introduce new products and services, allowing for real-time feedback before a full-scale launch.

4. Take Advantage of Technology

The latest pay-as-you-go insurance cover options use AI and the IoT to accurately predict how high customer premiums should be, making the service far more cost-effective and competitive.

How Customer-Centric Insurtech Can Leverage Technology

1. Streamlined Onboarding Process

One of the key areas where insurance companies can leverage technology to enhance the customer experience in the onboarding process. Traditionally, buying insurance coverage is a lengthy and cumbrous process, with customers having to fill out numerous forms and provide extensive documentation.

However, insurtech companies have revolutionized this process by applying technologies like artificial intelligence and machine learning. For example, some insurance startups have chatbot applications that can guide customers through the onboarding process.

These chatbots use natural language processing to understand customer queries and provide real-time responses. By leveraging such tools, insurtech companies can offer a more seamless and efficient onboarding experience, reducing the time and effort required from the customers.

2. Recommend Personalized Policies

Insurtech startups also utilize technology to offer their customers personalized policy recommendations. By leveraging data and machine learning algorithms, these companies can analyze customer data and suggest the most suitable insurance options for each individual.

Using technology, insurtech companies can analyze a customer’s personal information, such as age, location, and lifestyle habits, to determine their risk profile and recommend insurance policies that best fit their needs. This level of personalization not only helps customers find the most suitable coverage but also saves them time and effort in researching and comparing different policies.

3. Digitizing Claims Processing

Claims processing is another area where technology is transforming the customer experience in insurance. Traditionally, filing an insurance claim involved submitting physical documents and waiting for manual processing, which could take days or even weeks.

Insurtech startups are changing this by digitizing the entire claims process. For instance, some insurtech companies have developed mobile applications that allow customers to easily file claims by simply uploading photos or videos of the damages.

These applications use image recognition technology to assess the severity of the damages and automatically generate a claim estimate. This not only speeds up the claims process but also provides customers with a more transparent and hassle-free experience.

4. Enhancing Customer Communication and Support

Effective communication and support are essential for a seamless customer experience. Insurtech startups are leveraging technology to improve these aspects by offering various communication channels and self-service options.

For instance, some insurance companies have developed mobile applications that enable customers to access their policy information, make changes, and contact customer support directly from their smartphones.

These applications often include chatbot features that can provide instant answers to frequently asked questions, further enhancing the customer support experience.

The customers want shorter turnaround times ties and seamless interactions and prefer the ease of using a mobile to communicate. They don’t want to fill in lengthy application forms only to get their insurance policy a week later.

Conclusion

Customers typically expect things to be done in a matter of minutes and hours, not days. Automated solutions within predefined parameters can help expedite both policy purchases and claims processing.

Traditional insurance companies are feeling the pinch as insurtechs broaden their offerings. The industry’s move to customer centricity is driven by the simple fact that if insurers do not deliver the right combination of digital, mobile, in-person, and traditional channels – at the right time for the needs of each consumer – they will lose market share to newer insurance providers.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.