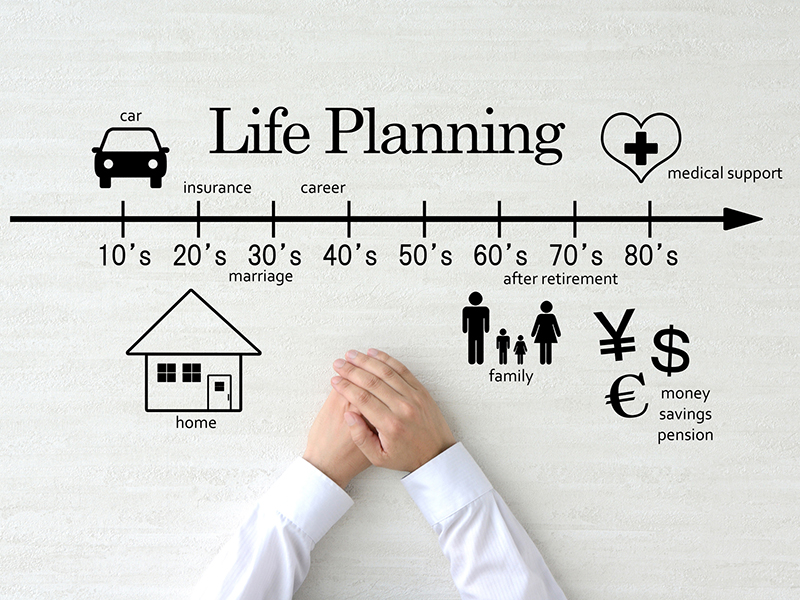

Life is a journey that encompasses various milestones, each with its own individual moments of happiness, tests, and obligations.

As we venture through the pivotal stages of life, our financial needs and insurance requirements evolve with us. Understanding how to modify your insurance coverage in response to these significant life changes is crucial for ensuring the protection of yourself and your loved ones.

We will go over a range of common life events and analyze how they can potentially alter your insurance needs, equipping you with the knowledge needed to make informed decisions that will safeguard your future.

Starting Your Career

Starting your career usually marks a significant step towards achieving financial independence. This marks the beginning of a steady income stream, making it essential to prioritize protecting and growing your future earnings.

To safeguard your financial well-being, it is important to consider building an emergency fund, exploring investment opportunities, and securing adequate insurance.

Insurance Needs

Health insurance: This will often be available through your employer, but you will need to understand what is covered and decide if other policies are required.

Disability Insurance: This will protect your income if you become unfit to work due to sickness or disability. Most young professionals can ignore it, but it’s a very important safety net.

Getting Married

Marriage is a significant milestone that involves not only the merging of two individuals but also the integration of their financial needs and plans.

It is important to take this opportunity to thoroughly review and reassess your joint insurance requirements to ensure that you both are adequately protected.

This may include evaluating health, life, disability, and property insurance to make sure your coverage aligns with your current situation and future goals as a couple.

Insurance Needs

Life Insurance: This is necessary to ensure the financial safety of the spouse. Compare both term and whole life policies.

Health Insurance: Compare the plans offered by both employers and choose the best, or opt for a joint policy that offers maximum coverage.

Auto Insurance: Consolidating policies usually attract discounts. Make sure both spouses are adequately covered by the policy.

Buying a Home

Investing in a home is a crucial decision that opens new opportunities and comes with financial responsibilities. It is a substantial decision that carries significant financial and personal implications.

Not only does it offer the potential for long-term financial growth and stability, but it also provides the opportunity to create a sense of permanence and belonging. However, it also involves various financial responsibilities such as mortgage payments, property taxes, maintenance costs, and insurance.

Therefore, it’s important to carefully consider all aspects before making this important decision.

Insurance Needs

Homeowners Insurance: This covers property damage and personal liability. Ensure that it’s based on the replacement cost of your home.

Mortgage Protection Insurance: In the event of death, it pays off the mortgage, which puts your family at peace.

Umbrella Insurance: This insurance covers more liability than policies on home and auto, so if you own a lot, you will want this insurance in place.

Starting a Family

While children bring increased joy and responsibility with them. Starting a family is also time to think of their future and their security.

Insurance Needs

Life Insurance: Boost your coverage to include any new dependents. Also, look for policies that pay for education expenses.

Health Insurance: Make sure that your policy includes pediatric care and other health needs unique to children.

Disability Insurance: Now more important than ever, as the financial well-being of your family is tied directly to your income.

Critical Illness Insurance: In the event of a serious illness, provides a lump sum to help with treatment and to ensure your family can maintain its lifestyle.

Career Advancement

As a person’s career progresses, it usually results in a higher level of income and the accumulation of more assets that require safeguarding.

Insurance Needs

More Life Insurance: As income and lifestyle increase, so too should life insurance coverage to mirror these new financial obligations.

Additional Disability Insurance: More income may require more disability insurance than an employer will offer with his or her package.

Retirement Planning: While not insurance per se, it is important to plan long-term care insurance and other insurance products that will serve to protect retirement.

Divorce

Divorce is a complex and difficult period that can have significant emotional and financial implications for both parties involved. During this time, it is crucial for individuals to reassess their financial situations and insurance coverage to ensure they are adequately protected and prepared for the future.

Insurance Needs

Life Insurance: Update beneficiaries and maintain a policy on your ex-spouse if you are counting on alimony or child support.

Health Insurance: Get individual health insurance if you were covered under your spouse’s coverage.

Home and Auto Insurance: Update the policies to reflect new ownership and living arrangements.

Retirement

The retirement stage brings about some major changes in a person’s life. During this time, individuals transition from the phase of earning a regular income to relying on their savings and investments to sustain their lifestyle.

Insurance Needs

Health Insurance—Transition from employer-provided health insurance to Medicare; supplemental policies allow more coverage.

Long-Term Care Insurance—Pays for long-term care services that can use up your savings very fast.

Life Insurance—Based on your financial condition and dependents, determine whether you still need life insurance protection. Consider purchasing policies with living benefits.

Losing a Loved One

Experiencing the passing of a spouse or a family member can be an incredibly challenging period both emotionally and financially. Experiencing the passing of a spouse or a family member can be an incredibly challenging period both emotionally and financially.

Insurance Needs

Life Insurance Proceeds: Be aware of the claim process and know how to avail yourself of it; use these funds to meet immediate expenses and long-term financial planning.

Health Insurance: If you were covered under your spouse’s health insurance, you need to update your health insurance.

Estate Planning: Be sure that your estate plan reflects your new situation by updating your beneficiaries and any inheritance plans.

Conclusion

It is very important to plan ahead for life’s major milestones regarding your insurance needs. The provision for you and your loved ones against any eventuality along life’s journey requires periodic reviews of your insurance policies.

For mental peace, it is usually advisable to engage a trusted insurance advisor who will offer personalized advice on making appropriate and relevant decisions. Proper insurance coverage can give you peace of mind and, thereby, financial security so that you can enjoy life at all stages.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.