Insurance plays a crucial role in providing a safety net by offering financial protection against a wide range of unforeseen events, including accidents, natural disasters, and health emergencies.

However, filing an insurance claim can be tedious and complex for many policyholders. To ensure that you receive the maximum payout from your insurance policy, it’s important to adopt a strategic approach by thoroughly understanding the terms and conditions of your policy and familiarizing yourself with the necessary steps.

Know Your Policy

1. Read the Fine Print

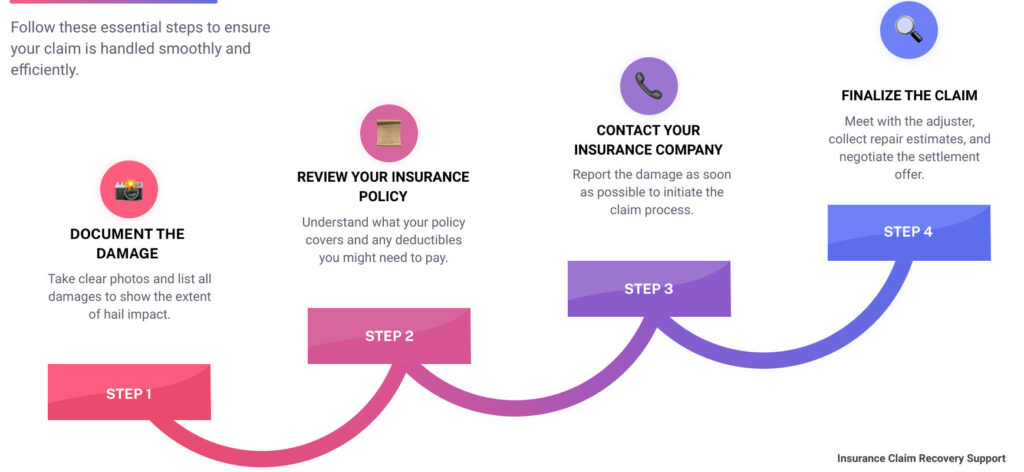

To maximize your insurance payout, it’s essential to understand your policy fully. This involves carefully reading through the terms and conditions, exclusions, and limitations. It’s important to pay attention to the coverage details, deductibles, and claims process. Understanding what your policy includes and excludes is a basic step to filing a successful claim.

2. Know Your Coverage Limits

Remember that every insurance policy comes with specific coverage limits. It’s important to be aware of these limits and understand how they apply to different types of claims. Knowing these limits will help you have realistic expectations for your payout and avoid surprises during the claims process.

3. Check for Riders and Endorsements

Riders and endorsements are extra provisions that can improve your insurance coverage. Take a look at your policy to find out if you have any riders, such as those for jewelry, electronics, or other high-value items. These additional provisions can significantly impact the amount of compensation you receive in the event of a claim.

Document Everything

1. Maintain a Detailed Inventory

When filing a claim, it’s important to have a detailed inventory of your possessions, including photos, videos, and receipts. This documentation is useful as proof of ownership and helps authenticate the value of your items, making it useful during the claims process.

2. Record All Interactions

Record and save all communications with your insurance company, including emails, letters, and notes from phone calls. This documentation is essential for resolving disputes during the claims process.

3. Document the Damage

In the event of an incident, promptly document the damage by taking clear, detailed photos and videos from multiple angles. This visual evidence will strongly support your claim and help the insurance evaluators assess the extent of the damage accurately.

File Claims Without any Delay

1. Report the Incident Immediately

Timely reporting of an incident to your insurance company is crucial for several reasons. Firstly, prompt reporting allows the insurance company to quickly assess the situation and take necessary steps, such as investigation and damage assessment.

This can help expedite the claims process and ultimately lead to a quicker resolution. Delaying reporting an incident can cause problems as evidence can be lost, and the finer details of the incident may be less clear after some time.

Delays in reporting violate specific deadlines outlined in your insurance policy, which can potentially result in a reduced or denied payout. Therefore, it is essential to be proactive in reporting any incidents to your insurance company to ensure a smooth and fair claims process.

2. Submit a Complete Claim

When you submit your claim, you need to double-check that all required forms and supporting documentation are complete and part of the claim. Providing accurate and comprehensive information will speed up the processing of your claim and potentially lead to a better payout for you.

3. Follow Up Regularly

It’s important to maintain regular communication with your insurance company throughout the claims process.

Following up on the status of your claim and providing any additional information or documentation in a timely manner can significantly impact the speed at which your claim is resolved.

Work with Professionals

1. Consult with Experts

When dealing with complex claims that encompass significant property damage or personal injury, it helps to seek guidance from experienced professionals.

This may involve consulting with contractors to assess property damage, appraisers to determine accurate valuations and medical professionals who provide detailed assessments related to personal injuries.

Seeking support from these experts can significantly strengthen your claim and ensure that you receive the appropriate compensation.

3. Legal Assistance

In certain extreme situations, it may be essential to seek legal help. If you come across significant challenges or disagreements with your insurance provider, seeking guidance from a lawyer who specializes in insurance claims can be beneficial.

They can provide valuable assistance in safeguarding your rights and ensuring that you receive the maximum payout you are entitled to.

Maximize Your Settlement

1. Negotiate with Your Insurer

When dealing with your insurance company, it’s important not to accept the first settlement offer without negotiating. Take the time to carefully review the offer and compare it to the losses you have documented.

If you find that the offer does not adequately cover your losses, gather additional evidence to support your claim and enter into negotiations with the aim of securing a higher payout.

2. Understand Depreciation and Replacement Costs

Insurance policies often consider depreciation when assessing the value of your claim. It’s important to understand that if your policy factors in depreciation, the payout for a claimed item may be less than its original cost. This can mean that you don’t get enough money to purchase a replacement for the claimed item.

However, some insurance policies offer replacement cost coverage, which can result in a higher payout. With this type of coverage, the insurer will compensate you for the full cost of replacing the damaged item with a new one, without deducting for depreciation.

This ensures that you can replace your belongings with new equivalents, which can be particularly beneficial for items that are subject to significant depreciation, such as electronic devices and appliances.

Before filing a claim, it’s essential to review your insurance policy to understand the type of coverage you have and how depreciation is factored into the settlement process. If your policy includes replacement cost coverage, you may have a better chance of receiving a payout that enables you to replace your damaged items with new ones.

3. Avoid Common Pitfalls

Be mindful of common mistakes that could decrease your payout, such as not documenting damage, missing reporting deadlines, and accepting low initial offers. Take the time to understand the claims process and be proactive in representing your interests.

Maintain Your Policy

1. Review Your Policy Annually

Review your insurance policy regularly to ensure it meets your needs. Life changes, such as purchasing new property or major life events, may necessitate adjustments to your coverage. An annual review can help you stay adequately protected and maximize potential payouts.

2. Update Your Inventory

It is important to regularly update your insured inventory with any newly acquired items and any changes to your possessions.

This will ensure that your documentation is current and accurate, which is crucial for substantiating any insurance claims or financial records. Keeping a detailed and up-to-date inventory will also help you stay organized and informed about your assets.

3. Consider Higher Coverage Limits

If you find that your existing coverage limits are no longer sufficient to protect your financial interests, consider raising them. By increasing your coverage limits, you can enhance the level of financial protection you receive and potentially secure higher payouts in the event of a claim.

Conclusion

Maximizing your insurance payout requires a proactive approach, detailed documentation, and a thorough understanding of your policy. By following these tips, you can go through the claims process with more success and ensure you receive the compensation you deserve. Remember, the key to a successful claim is preparation, persistence, and a clear understanding of your rights and responsibilities as a policyholder.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.