What do you do if a sudden event wipes out a family’s savings or pushes a small business into debt? In Pakistan, where a significant portion of the population does not have access to formal financial services and traditional insurance products, microinsurance plays a crucial role in promoting financial inclusion.

Micro health and life insurance specifically target low-income individuals and small businesses, providing them with affordable protection. These insurance products serve as a safety net, offering financial security in the event of illness, accidents, or unfortunate loss of life.

By providing access to these essential insurance products, microinsurance contributes to the financial empowerment of underserved communities, helping them mitigate the financial risks associated with unforeseen events.

What is Microinsurance?

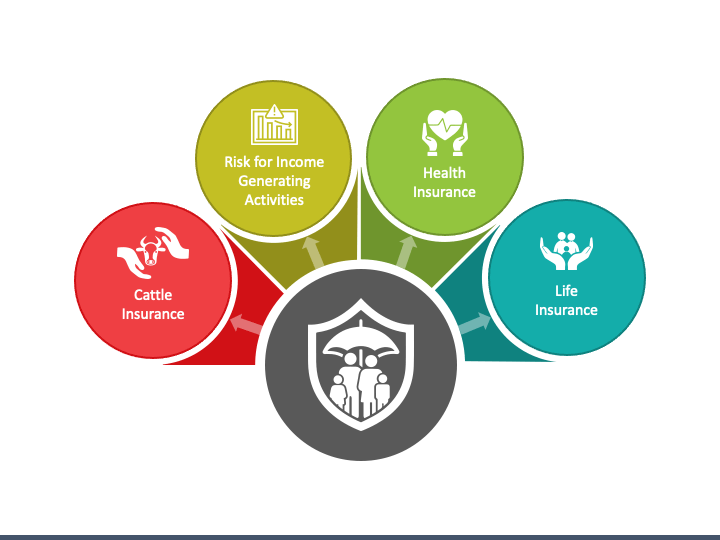

Microinsurance is designed to offer affordable, accessible, and simplified insurance products tailored for individuals and families in lower-income brackets. It covers life, health, property, and other risks, but with smaller premiums and coverage limits than traditional insurance products.

In the context of Pakistan, where many workers operate in informal sectors or as daily wage earners, microinsurance can be a game-changer. It provides access to basic healthcare and financial protection, which would otherwise be unaffordable for many.

How Micro Health Insurance Works

Micro health insurance provides affordable healthcare coverage to low-income individuals and families. It typically covers basic medical expenses such as hospitalization, surgery, and doctor consultations.

How Micro Life Insurance Works

Micro life insurance provides low-income individuals with financial protection in case of death. The main objective is to ensure that the family or dependents of the deceased are not left in a financially vulnerable position

The Need for Microinsurance in Pakistan

With over 70% of Pakistan’s population living without health insurance and a large informal economy, the need for affordable insurance products is undeniable. Many low-income families cannot afford to pay out-of-pocket for healthcare expenses, and the lack of life insurance leaves families vulnerable to financial hardship in the event of a breadwinner’s death.

Micro health and life insurance can fill this gap by:

- Providing a safety net for vulnerable families who cannot afford traditional insurance.

- Promoting financial inclusion, helping more people gain access to financial services.

- Improving access to healthcare, which can lead to better health outcomes and reduced poverty.

The Role of Businesses in Promoting Microinsurance

For businesses operating in Pakistan, especially those employing low-wage workers, offering micro health and life insurance as part of the employee benefits package can be a strategic advantage. Here’s how businesses can benefit:

- Employee Retention and Satisfaction: Offering microinsurance shows that the company values its employees’ well-being, leading to higher employee security and retention. This is particularly important in sectors like manufacturing, construction, and agriculture, where turnover can be high.

- Improved Productivity: When employees have access to healthcare through microinsurance, they are more likely to seek timely medical treatment, reducing absenteeism due to illness and improving overall productivity.

- Corporate Social Responsibility (CSR): Providing microinsurance aligns with corporate social responsibility initiatives, showing that the company is committed to improving the lives of its employees and their families. It also helps build a positive image in the local community.

- Cost-Effective Solution: Microinsurance offers a cost-effective alternative for smaller or more financially insecure businesses that want to offer insurance benefits but cannot afford traditional policies. It provides essential coverage without putting a financial strain on the company.

Challenges and the Way Forward

While microinsurance holds significant potential, it faces several challenges in Pakistan, including low awareness, distribution barriers, and trust issues. However, partnerships between insurance companies, NGOs, and the government can help overcome these hurdles.

For example, State Life Insurance and EFU Life have developed microinsurance products tailored to Pakistan’s market. Government initiatives like the Sehat Sahulat Program have also expanded access to healthcare for lower-income groups, creating more awareness around the importance of insurance.

Conclusion

Micro health and life insurance are essential tools that play a critical role in providing financial security to the low-income population in Pakistan. These insurance products are designed to offer protection in the event of unexpected health issues and provide coverage for life events, thereby contributing significantly to financial stability and poverty reduction. By offering affordable and accessible insurance options, these products ensure that individuals and families have the necessary support to navigate challenging circumstances without facing financial hardship. In addition to safeguarding against unforeseen medical expenses and life uncertainties, micro health and life insurance also empower communities by promoting a culture of financial resilience and long-term economic well-being.

By offering microinsurance, businesses can not only enhance employee benefits and improve productivity but also demonstrate a strong commitment to social responsibility. As the demand for affordable insurance continues to grow, businesses and insurers in Pakistan have a unique opportunity to collaborate and drive significant change in the insurance landscape, making a positive impact on the community and the business environment.

By understanding how microinsurance works and its benefits, businesses can make informed decisions about incorporating these products into their operations, contributing to a more financially inclusive Pakistan.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.