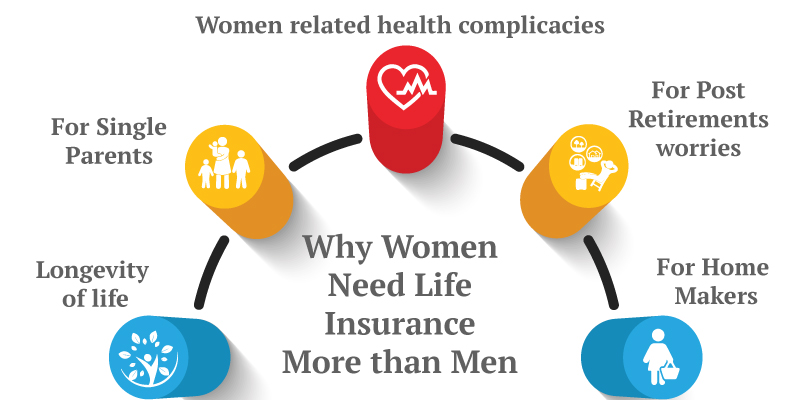

Who do you think needs life insurance the most? Traditionally, the answer was men, as they were the primary breadwinners. While this was true in earlier years, this narrative doesn’t reflect the realities of the modern world.

Women today are not only key contributors to household incomes but also often take on caregiving roles, managing household finances, and contributing significantly to long-term family stability.

Today we explore why women should prioritize life insurance as a cornerstone of their financial planning. From ensuring financial stability to securing their family’s future, life insurance is a critical tool that every woman should consider.

Women Are Key Contributors to Household Income

In the contemporary family structure, women are no longer just homemakers. They are actively involved in supporting their families financially, whether through full-time employment, running their own businesses, or part-time work. This shift in roles underscores the importance of life insurance for women.

In a family where a woman’s income is needed to cover essential expenses like rent, groceries, or education costs, if something unforeseen were to happen to her, the family could face severe financial hardships.

A life insurance policy can act as a safety net, providing funds to cover immediate and long-term expenses, ensuring the family’s financial well-being remains intact.

The Financial Value of Caregiving

Even when women are not earning a direct income, their contributions as caregivers have immense financial value. Women often take on the role of managing households, raising children, or caring for elderly family members. If they were no longer around, the cost of replacing these services could be substantial, making life insurance a crucial financial tool.

For example, hiring a nanny, housekeeper, or elder care professional could strain a family’s finances. A life insurance policy can provide the necessary funds to cover these costs, reducing the emotional and financial burden on the surviving family members.

Rising Education and Healthcare Costs

Women often put their children’s education and healthcare first. However, these costs are increasing worldwide, and unexpected events can disrupt plans for a child’s future.

Life insurance can provide money for important expenses like tuition fees, extracurricular activities, and medical treatments. By getting a policy, women can help ensure their children’s futures stay bright, even if they are not there.

Coverage for Single Women

Many single women may assume that they don’t need life insurance because they don’t have dependents. However, life insurance isn’t just about providing for others; it’s also about protecting yourself and your assets.

For single women with loans, mortgages, or other financial obligations, life insurance can ensure that debts don’t become a burden on family members. Additionally, certain policies allow for cash value accumulation, providing a financial resource that can be used later in life for retirement, emergencies, or other needs.

Women Live Longer Than Men

Statistically, women tend to outlive men, but living longer also comes with increased financial responsibilities. Women may need more savings to support themselves during retirement, cover long-term care costs, or manage medical expenses in their later years.

Permanent life insurance policies can help women build a cash reserve over time. This reserve can be used to supplement retirement income, cover healthcare costs, or serve as a financial cushion in case of unexpected expenses.

Life Insurance Is More Affordable for Women

One significant advantage for women is the affordability of life insurance. Premiums are often lower for women than for men, making life insurance an attractive and feasible financial product for women who want to secure their families’ futures without overstretching their budgets.

This affordability makes life insurance an attractive financial product for women who want to secure their families’ futures without overstretching their budgets.

Empowerment Through Financial Independence

By owning a life insurance policy, women take control of their financial futures and ensure that their loved ones are protected regardless of external circumstances.

Life insurance also empowers women to make other financial decisions confidently, knowing that their safety net is in place. Whether they choose to invest, start a business, or pursue further education, having life insurance in their portfolio can provide a profound sense of peace of mind.

Women-Owned Businesses Need Protection

For women entrepreneurs, life insurance is more than just a personal safety net—it’s a business asset. Many women-run businesses rely heavily on the owner’s expertise, leadership, and financial contributions. A life insurance policy can be structured to support a business in case of the owner’s untimely demise, ensuring the business’s survival and growth even in challenging times.

A life insurance policy can be structured to support a business in case of the owner’s untimely demise. It can provide funds to cover operational expenses, pay off business loans, or even support a succession plan. This ensures that the business survives and thrives even in challenging times.

Financial Security for Aging Parents

In many cultures, women play a significant role in supporting their aging parents financially. Life insurance can help ensure that this support continues, even if the unexpected happens.

For example, women can opt for policies that designate their parents as beneficiaries, providing them with a steady source of income in the event of their daughter’s passing. This is particularly important for parents who depend on their children for medical expenses, housing, or daily needs.

Final Thoughts: Protecting What Matters Most

For women, life insurance offers a way to secure their future as well as their loved ones, support their aspirations, and achieve peace of mind.

Whether you’re a working professional, a stay-at-home caregiver, or a business owner, life insurance is an essential component of your financial plan. Don’t wait for the “right time” to invest in life insurance—the best time to start is now. By prioritizing life insurance, you’re taking a significant step toward building a financially secure future for yourself and your loved ones.

Take control of your financial future today. Consult with a trusted insurance advisor to explore the best life insurance options tailored to your needs.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.