Many industry experts agree that the traditional insurance model is slow to accept or even consider new technologies like all financial institutions. This means that the insurance industry is past due for some big innovations and the rise of insurtech is changing this.

Fintech companies are launching new technologies and business models to the insurance industry, which is leading to increased innovation in service offerings. Let’s first understand what insurtech is before going into deeper details.

What is Insurtech?

As the world is rapidly accepting technological innovations, the insurance industry has also experienced a significant change in its operations, due to progression in technology. The traditional insurance process now has significant technological processes and practices incorporated into its business model.

This has led to the term “insurtech” being coined. This combination of insurance and technology allows insurance companies to improve operations, and customer experience, and redesign their business models to become more cost-effective. There are many insurance providers that are now sole reliant on technology to offer their clients innovative new products,

Why is Insurtech so Popular

Insurtech is growing due to multiple factors. The major one is the increasing use of mobile devices. The expansion of the sharing economy and the aging population globally are other major influences.

Insurtech companies generally use data analytics to better segment their markets and customers. This allows them to offer more personalized insurance products. Customers are likelier to get the coverage they need at an affordable price.

For instance, an insurtech company usually offers young drivers a lower premium if they consent to have a telematics device in their car. This allows the Insurtech company to protect its risk, while the young driver gets cheaper insurance.

Insurtech companies use artificial intelligence (AI) and data analytics to separate their customers and offer them suitable insurance products. For example, an insurance company might use AI to identify customers who are at high risk of flooding and offer them a flood insurance policy.

All these factors have increased the demand for better insurance products and services, which in turn is driving innovation in the insurance industry.

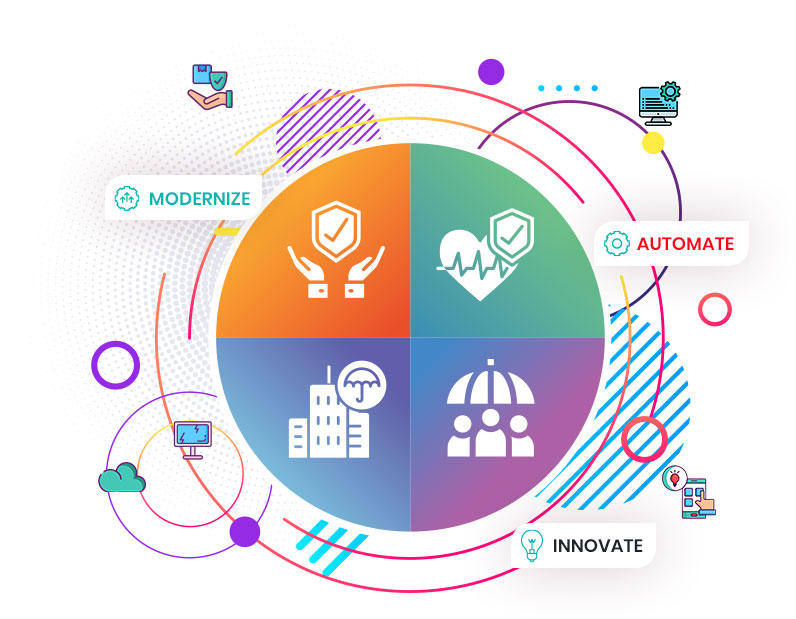

How Insurtech is Changing the Industry

How Insurance is Sold and Serviced

In the past, insurance was usually sold through insurance agents and brokers. This meant multiple sessions with these brokers and their agents as they handled your queries and designed a policy according to your budget and requirements.

Insurtech companies now rely on technology to make it easier for consumers to buy insurance online. Internationally insurtech companies also use technology to provide insurance products in new ways, like through mobile apps or wearable devices like fitness trackers and smartwatches.

Digitalization and Automation

One of the basic forces behind the Insurtech revolution is the digitalization of business processes and the extensive adoption of automation. Insurers are using technologies such as artificial intelligence (AI) and machine learning to automate insurance underwriting, claim processing, and risk assessment. This helps to increase business efficiency and also reduces the chance of human error. This means that businesses get more accurate results in a shorter time.

Data Analysis and Modeling

Insurtech companies are amongst the most well-known users of big data and its related analytic tools. Insurance companies have always been users of big data, but now automation and other tools allow insurtech companies to get valuable insights into customer behavior, and market trends, and develop more accurate risk profiles.

Advanced data analytics allow insurers to make more educated decisions, and to offer their target market more customized products. It also allows them to predict potential risks more accurately. Predictive modeling tools help to forecast future claims, allowing insurers to manage and mitigate risks more effectively.

Blockchain Technology for Enhanced Security

Blockchain technology is suitable for the insurance industry as it tackles key challenges in the industry like data security, transparency, and fraud prevention. Many insurance providers are using blockchain to develop their secure and transparent databases and reduce the probability of fraudulent claims.

Smart contracts, a core feature of blockchain technology, enable automated and tamper-proof execution of insurance policies. This allows insurance companies to streamline their processes and improve the security concerns among stakeholders.

IoT (Internet of Things) Innovation

The integration of IoT devices has new potential for insurers. The device connectivity that it supports, like telematics in automobiles or wearable health trackers, allows for real-time data availability that insurers can use for more accurate risk assessment. This data-driven approach allows for much more personalized insurance plans and rewards policyholders for adopting safer behavior.

Customer-Centric Solutions

Insurtech allows businesses to place a stronger emphasis on customer-centricity. It supports them in providing a seamless and personalized experience. Mobile apps, online portals, and chatbots are commonplace, allowing customers to easily purchase policies, file claims, and receive support. The use of AI-driven chatbots enhances customer engagement by providing instant responses and assistance.

On-Demand and Usage-Based Insurance

The availability of data tracking and recording is allowing traditional insurance models to give way to more flexible and customer-friendly options. Insurtech companies have also introduced on-demand insurance, where customers can activate or deactivate coverage as needed.

Usage-based insurance, tied to specific behaviors or events, allows policyholders to pay premiums based on their actual risk exposure, fostering a fairer and more transparent system.

The rise of Insurtech represents a decisive moment in the history of insurance. Technology is not only enhancing operational efficiency but also redefining the relationship between insurers and policyholders.

As Insurtech continues to evolve, we can expect further innovations that will reshape the industry, creating a more adaptive, customer-focused, and digitally-driven insurance landscape. Embracing these technological advancements will be crucial for insurers looking to stay competitive and meet the evolving needs of a tech-savvy and demanding customer base.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.