Micro-investing is a modern and innovative financial strategy that empowers individuals to invest small amounts of money gradually at regular intervals. This approach offers an accessible and uncomplicated entry point for newcomers to begin crafting their investment portfolio without requiring a large initial sum of money.

Microinvesting in Pakistan is just starting to take off, with several banks facilitating microinvesting through their banking apps. Notable amongst these are the Zindagi app by JS Bank, as well as the HBL, and Meezan banking apps, which facilitate investments in their mutual funds through their bank accounts. These allow users to invest small amounts, as low as PKR 1,000 into their stock or mutual fund accounts.

This guide will give you a thorough understanding of micro-investing in Pakistan and outline its advantages.

What is Micro-Investing?

Micro-investing is a method of slowly accumulating savings by investing small amounts of money. It’s similar to collecting spare change in a digital format and then using it to grow your investments.

On international platforms, users can link their debit cards to their accounts. Whenever they make a purchase, the app automatically rounds up the transaction to the nearest dollar and invests the leftover change into a designated investment account. This allows people to invest small, manageable amounts over time, ultimately contributing to their long-term financial goals.

Micro-investing is a strategy that involves regularly investing small amounts of money over time. Unlike traditional investing, which typically requires larger sums of capital, micro-investing allows individuals to start with as little as a few thousand. This approach is especially attractive for beginners in the world of investing or for those with limited funds to allocate towards investments.

The Benefits of Micro-Investing

Micro-investing has gained popularity in recent years due to its unique advantages, especially for individuals new to investing or with limited funds. Here’s a detailed look at the key benefits of micro-investing:

Accessibility:

One major advantage of micro-investing is that it enables you to start with very little money. Traditional investing often demands significant initial capital, which can be a hurdle for many.

Micro-investing platforms, on the other hand, permit you to start with as little as a few thousand, thus making investing accessible to a wider audience.

Diversification:

While many international micro-investing platforms offer diversified investment options, which helps reduce risk and increases the potential for steady growth. In Pakistan, we are currently restricted to stocks and mutual funds and cannot spread our money across multiple investment options.

Affordability:

With micro-investing, you can begin investing with very little money. This makes it possible for anyone to start building their wealth, even if they can only contribute small amounts at a time. with the use of banking or investing apps, you can transfer a few thousands into your investment account and earn some additional profit from it.

Smaller Investments:

Since micro-investing involves small amounts of money, the financial risk is relatively low. This makes it an excellent option for those who are risk-averse or just starting their investment journey. It allows investors to gain experience and confidence without fearing losing a significant sum of money.

Learning Opportunity:

Micro-investing serves as a practical learning tool. With minimal financial risk, investors can experiment with different investment strategies and learn about the market’s dynamics without the pressure of substantial financial loss.

Consistent Savings Habit:

Micro-investing encourages a consistent savings habit. By investing small amounts regularly, you can develop a disciplined approach to saving and investing, which can pay off in the long run.

A word of advice: don’t be unsettled by reductions in your investment amount over the short term; it is part of standard stock and mutual fund market fluctuations.

How to Get Started with Micro-Investing

Unfortunately, there is currently no organized or official micro-investing platform in Pakistan. Most of the apps available require that you open an account with the financial service provider or register with the mutual fund.

After this, micro-investment can be easily done through the many mutual fund apps, which usually require an initial deposit of PKR 5,000 and monthly contributions of as low as PKR 500. This can be done both through physical visits and through phone apps.

Why Micro-Investing is Important

Micro investing is at the takeoff stage, with many financial institutions beginning to explore avenues for offering investment options for small investors. There are multiple options for large-sum investors like fixed-income certificates, the evergreen SSCs, and DSCs, the small denominations of which are also good options for micro-investments.

Large investors can also invest in the Stock Exchange, buy prize bonds, SSCs, DSCs, and invest in gold and real estate. Microinvesting allows individuals with smaller amounts to invest and with smaller risk appetites to invest their capital safely.

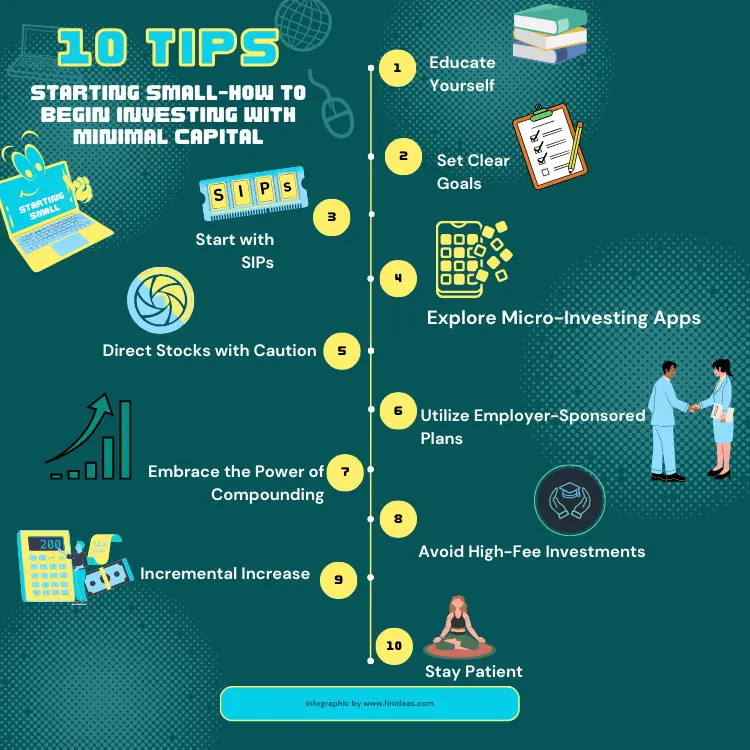

Whatever the avenue you choose, the following tips will help you grow your micro-investment pool steadily.

1. Start Small and Be Consistent:

Don’t worry about investing large sums of money right away. Start small and focus on consistency. Over time, these small investments can grow to a sizable amount.

2. Take Advantage of Educational Resources:

Many micro-investing platforms offer educational resources like articles, videos, and webinars. Utilize these resources in the Pakistani context to learn more about investing and make informed decisions.

3. Be Patient:

Investing is a long-term game. Be patient and avoid making impulsive decisions based on short-term market fluctuations. Stick to your strategy and allow your investments to grow over time.

Conclusion

Micro-investing is an excellent way for beginners to get started in investing. With low entry barriers and the ability to start with small amounts of money, it’s an accessible and effective strategy for building wealth over time.

You can begin your journey toward financial growth and stability by choosing the right platform, setting up your account, and investing consistently. Remember to monitor your investments, stay informed, and be patient as your nest egg grows through micro-investing.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.