Facing repeated financial challenges with no safety net to fall back on is a harsh reality for millions of people in low-income communities. In the insurance industry, microinsurance has emerged as a critical tool for financial inclusion, particularly for vulnerable populations.

Microinsurance is designed to offer coverage to those who may not have access to traditional insurance due to its cost, complexity, or lack of awareness. However, despite its growing importance, microinsurance is often misunderstood.

We will explore the various types of microinsurance, debunk common myths, and highlight the key differences between microinsurance and traditional insurance.

What is Microinsurance?

Microinsurance refers to insurance products tailored for low-income individuals and families who are often excluded from conventional insurance markets. The premiums are kept low, and the coverage is designed to address the specific needs and risks these communities face, such as health emergencies, crop failure, and property loss.

The goal is to provide a safety net to prevent financial ruin in the face of unexpected events.

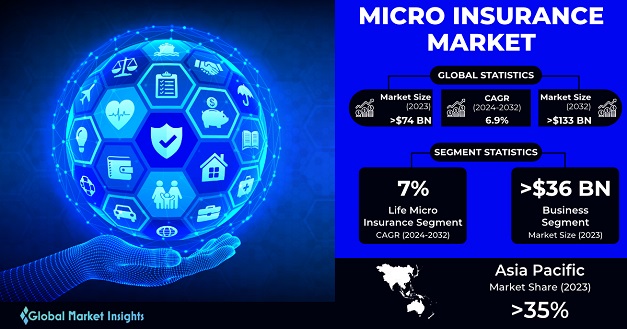

The above infographic by Global Market Insight shows the potential of microinsurance in our region.

Types of Microinsurance

1. Health Microinsurance

Health microinsurance offers protection against medical expenses arising from illness or injury. It is often the most sought-after type of microinsurance, especially in regions where public healthcare is inadequate or expensive. These plans may cover hospitalization, doctor consultations, medication, and sometimes even preventive care.

2. Agricultural Microinsurance

In many developing countries, agriculture is the primary source of livelihood. Agricultural microinsurance helps farmers manage risks associated with natural disasters, pests, and crop failure. This type of insurance can cover loss of crops, livestock, or even income in case of adverse weather conditions.

3. Life Microinsurance

Life microinsurance provides financial support to the family of the insured in the event of their death. The coverage amount is typically smaller than traditional life insurance, but it is sufficient to help the family cover immediate expenses like funeral costs and outstanding debts.

4. Property Microinsurance

Property microinsurance covers damage or loss of property due to events like fire, theft, or natural disasters. This is particularly important in areas prone to environmental risks where losing a home or business could be devastating.

5. Microinsurance for Small Businesses

Microinsurance also caters to small business owners, providing coverage for risks associated with running a business, such as damage to inventory, theft, or liability. This type of insurance helps entrepreneurs in low-income communities protect their livelihoods and rebuild after setbacks.

Despite its benefits, several myths surround microinsurance, which can deter potential clients from taking advantage of it. Let’s clarify some common misconceptions:

Myths About Microinsurance

1. Myth: Microinsurance is Just Another Name for Traditional Insurance

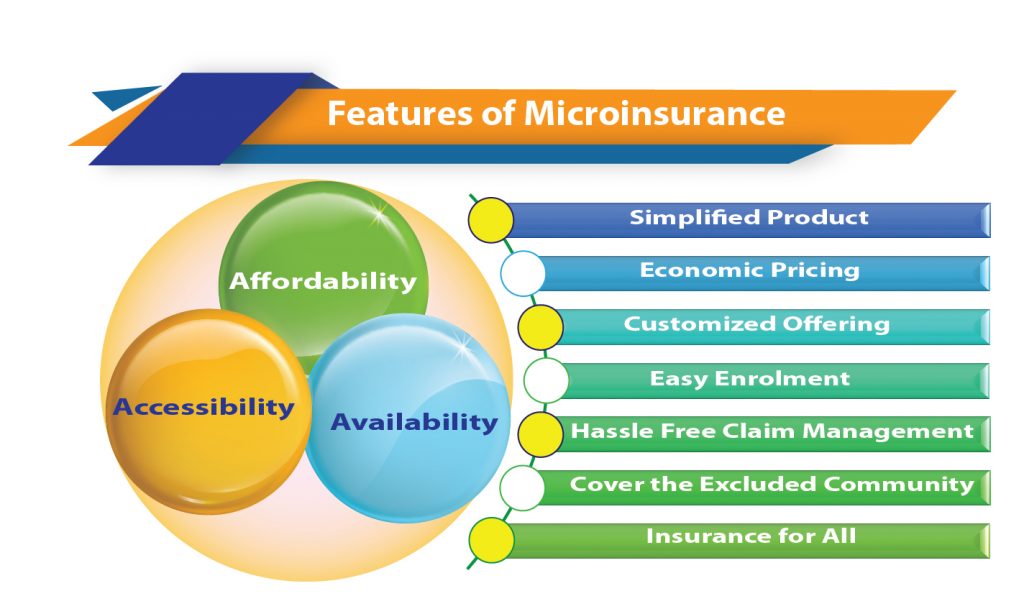

Reality: While microinsurance and traditional insurance share the same fundamental principles, they differ significantly in terms of accessibility, affordability, and coverage. Microinsurance is specifically designed for low-income individuals, offering simpler products at lower premiums.

2. Myth: Microinsurance Provides Insufficient Coverage

Reality: Although microinsurance policies often have lower coverage limits than traditional insurance, they are designed to meet the insured’s specific needs. The coverage is tailored to be sufficient for the policyholder’s context, whether it’s providing healthcare, securing a home, or protecting crops.

3. Myth: Microinsurance is Too Complicated for Low-Income Individuals

Reality: Microinsurance is designed to be simple and easy to understand. The terms are straightforward, and providers often engage in education and outreach to ensure that policyholders fully comprehend their coverage.

4. Myth: Microinsurance is Not Sustainable for Providers

Reality: Microinsurance can be sustainable and profitable for providers when properly managed. Innovations in technology, such as mobile banking and digital payments, have reduced administrative costs and made it easier for providers to reach a broader audience.

5. Myth: Microinsurance is Only for Rural Populations

Reality: While microinsurance is vital in rural areas, it also benefits urban low-income populations. Urban dwellers face health issues, property loss, and unemployment risks, which microinsurance can help mitigate.

Difference Between Microinsurance and Traditional Insurance

Understanding the difference between microinsurance and traditional insurance is crucial for recognizing the unique value that microinsurance offers.

1. Target Audience

Traditional insurance primarily targets middle to high-income individuals and businesses, offering a wide range of products that can be complex and costly. In contrast, microinsurance is aimed at low-income populations who may not have access to or be able to afford traditional insurance products.

2. Premiums and Coverage

One of the most significant differences lies in the premiums and coverage amounts. Traditional insurance usually comes with higher premiums and larger coverage limits, making it suitable for those with more significant assets to protect. Microinsurance, on the other hand, has much lower premiums and coverage amounts, designed to be affordable for those with limited financial resources.

3. Product Design

Traditional insurance products tend to be complex, with various options, riders, and exclusions. Microinsurance products are simpler, focusing on essential coverage with minimal exclusions and straightforward terms. This simplicity ensures that policyholders understand their policies and can make informed decisions.

4. Distribution Channels

Traditional insurance is often sold through agents, brokers, or direct marketing, requiring face-to-face interactions or substantial marketing efforts. Microinsurance, however, leverages alternative distribution channels, such as mobile phones, local cooperatives, and microfinance institutions. These channels make it easier to reach underserved populations.

5. Claim Process

The claim process in traditional insurance can be cumbersome, with extensive documentation and longer processing times. Microinsurance claims are typically processed faster, with minimal paperwork, to ensure that policyholders receive their benefits quickly in times of need.

6. Regulation and Support

Microinsurance often operates under different regulatory frameworks compared to traditional insurance. Governments and international organizations frequently support microinsurance initiatives as part of broader financial inclusion strategies. These initiatives may include subsidies, tax incentives, or technical assistance to make microinsurance more accessible.

Conclusion

Microinsurance plays a vital role in providing financial security to low-income individuals and families who are often excluded from traditional insurance markets. By understanding the types of microinsurance available, debunking common myths, and recognizing the differences from traditional insurance, individuals and communities can better appreciate the value of this essential financial tool. As microinsurance continues to evolve, it has the potential to significantly improve the lives of millions by offering protection against life’s uncertainties in a way that is accessible, affordable, and sustainable.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.