While we speak about the GDP to Tax ratio, unfortunately, Pakistan stands in the lowest ranking. To brief a layman we can simply explain that tax to GDP ratio is a kind of formula that is used to assess the development of a country on yearly basis.

According to the economic experts, the higher the GDP (Gross Domestic Product), the more tax revenues government of the specific country can earn. This is so because of the value of goods and services of the country increases.

Also read: How to Manage your Expenses when you get Unemployed in Pakistan

Although sounds boring but the information is of a great importance for all the general public as every person takes an individual participation in stabilizing or jolting the economy of a country. Thus for those who are salaried people of the society, it is a must to have concerns about their income tax return.

In the year 2018, with changing economic conditions of Pakistan, there is more need for the society to know their tax-related liabilities. For this reason, we have gathered all the basic yet necessary information to make you understand how to file your income tax return and reap the benefits as a tax filer.

Most salaried people have had their own bank accounts where they get their salaries. And to those, this information is clear that the real-time interbank fund transfer is charged with the withholding taxes, also called as WHT. The WHT is charged under the section 236P of the Income Tax Ordinance 2001 for the non-filers. According to this newly rule the bank to bank transactions is charged at approximately 0.3% WHT unless the beneficiary or the owner of the account files his income tax within the given time period.

You can also get charged a bit more while buying an automobile or any appliance. Also in case when withholding tax is more than the applicable tax on an appliance, tax filing will be the only way that can help to get a refund and save thousands of rupees.

Also read: 9 Things to Check Before Buying a Used Car

Also, if you are filing a tax return, there are more chances that you will be served with better services at the excise office, at the airport and a number of other benefits that are generally not given to non-filers.

If you are looking to save some extra amount of money each year, here is the simplest guide to file a tax return in Pakistan. This guide will help you understand how to file tax return online without any hassle. Plus, with this guide, you don’t need to look for and pay any tax consultant to deal with tax filing process. Another perk of this guide is that with online and easy to do services you can file your return in minimum time and efforts that you can easily adjust to your busy routine.

How to get started?

Preparing the ingredients is important before performing any activity. So before sitting online to file your tax return, you must prepare for all the things that you will need during the process. Having a valid CNIC is the most important thing to have.

According to recent tax amnesty scheme by Government of Pakistan, there is a ZERO tax if the annual income of a person is up to PKR 1.2 million. Means an individual who has a monthly income of about PKR 100,000 will have to pay no tax.

But if you are earning more than PKR 1,200,000/- in a year, then you are eligible to pay tax. And filing this tax return online can help you save a lot of time and hassle. And the quantity or rate of tax is determined by the government on yearly basis and is done on the basis of the annual budget.

Also read: 25 Ways to Save Money in Pakistan if You are a Salaried Person

The tax rate is determined in the month of June every year. Before filing the tax return on the website of the FBR, you need to calculate your net income in one year and tax that implies on it. This calculation is done on the basis of the income slab you belong to.

Online registration process for individuals

The individuals need to get registered on E-Enrollment system available on the website of FBR. With the recent updates, back in 2017, the FBR launched a SRO (Statutory Regulatory Orders) according to which the tax return filer can use the CNIC or the National Tax Number to proceed.

Below is a step by step procedure how to register as an individual tax return filer on FBR:

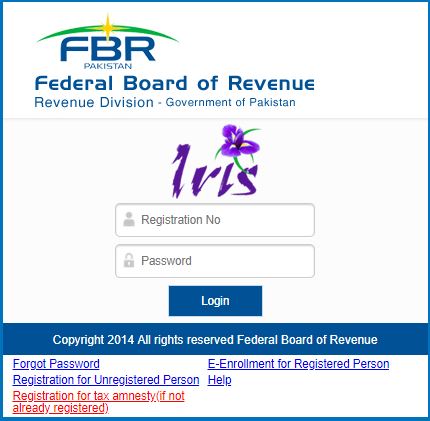

- You need to get to the main page of IRIS which is a simple ERP system specifically designed for the taxpayer registration.

- Then you have to get the “Registration Number” and the Password from the E-Enrollment process of the FBR.

- In the next step, you need to go to the link for “Registration of Unregistered Person”. You have to visit the link and register only for once. During the process, you will get a confirmation email or SMS on your registered mobile number. You will also get a Pin or Password to login to your account. For security reasons, sometime this password may take some days.

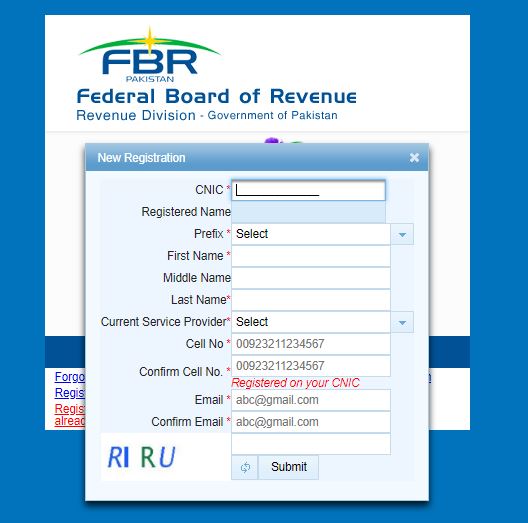

- The screen will look something like shown below. You will need to fill-up all the sections given in the form.

- Once you fill up the form and logged into your account by entering the registration number and password on the main page of the IRIS, you are now ok to proceed with filling the wealth statement.

- If you are a salaried person, you will need to fill up the wealth statement to proceed with income tax return. To read the process of filing wealth statement, click here.

Important things to note

The User ID for the IRIS is your registration number. The details of which are as below:

- For an Individual Pakistani you need a 13-Digit mentioned on the CNIC/NICOP. Do not mention dashes in the number.

- For a non-Pakistani individual, the 7 digit NTN should be given, without dashes.

- While in case of a company or an AOP, the 7 digit NTN number should be used without dashes.

Last words:

We have tried to offer you the maximum details about the process in the easiest to do manner. And we hope this guide will really help you to deal with the process. As discussed previously the idea behind the whole discussion is that you need to file your tax return to be a positive part of the society and the economy. It also helps you to avoid the WHT transactions by your bank.

Thus while filing the return, you can claim the WHT from the FBR. After carrying out the audit, FBR will send you a cheque, if they find that you qualified for refund. Despite the fact that the government of Pakistan still needs to, and is working, to reform the tax mechanism to help the law-following citizen in Pakistan. We still hope that the FBR continue streamlining the process of fixing the tax returns efficiently.

A.O.A any person who want to get NTN or filing of Income Tax Return/Sales Tax Return or any guide line about Tax matters please contact me I will help you free of cost . Free of Cost. You can contact me By email: mohsinsajjad92@gmail.com cell : 03154848989