On the busy roads of Pakistan with thousands of vehicles, there is one common entity that takes place every day on these roads, Accidents. Accidents are those unpredictable events that result in injuries and sometimes death. Sometimes the job you’re doing involves the risk of facing accidents. Life is challenging as our lives gets involve with potential risk. With that, the need for “Personal Accident Insurance” is increasing.

Dr Salman Zubair mentioned that Pakistan ranked first in Asia and 48th in the world for most deaths caused by traffic accidents. Referring to the World Health Organization (WHO) 2015 Report, he said that nearly 1.2 million people die each year and 20-50 million people suffer non-fatal injuries due to road crashes.

another one!!!

Around 36,000 people were killed in road accidents across the country last year and therefore, the Motorway police are making all efforts to check such deaths by ensuring adherence to traffic laws by road users

Dawn-News 2019

Following are some of the cases that will help you to understand the need and importance of this product:

1) Yasir is a first-year student at an engineering university. One day he got late for his class due to his puncher bike. He decided to take a bus that takes 10 minutes time to his institute as he approaches towards the bus, the crowd started to run and get into the bus there is no space left. He decided to hang in by holding a stand near the door. Since the bus is overloaded, someone from the bus falls on to him and eventually, he falls off the bus and while falling, he supported himself with his hand on the road. His arm bone breaks due to the pressure of his body. In this emergency he rushes towards the nearest hospital and there he got himself treated and in the end,doctor hands him over a heavy amount to be paid.

2) Mr Ahsan and family have decided to take vacations and travel by road to the northern areas of Pakistan. While they pack their bags and take all the safety measures they don’t know what is coming . While travelling, the weather conditions deteriorated resulting in Landsliding. The car encounters an accident and half of the family suffer severe injuries, the rest of them died on the spot.

3) Umer is an 18-year-old boy and he has gone for late-night studies at his friend’s place somewhere in Defence. At 6 O’clock early morning, he decides to come back home. One of his friends gives him a ride on his bike. On the way back, their bike gets hit by a heavy truck on Baloach Bridge and their Umer got his face scraped on the road badly with friction due to which his face got a severe injury which requires almost 40 stitches to intact the skin back. Whereas his friend got a few scratches on his hands.

In all these above cases, one thing is common. The accidents are unforeseeable and out of human control. These tragedies don’t come free. It does not only cause emotional damage but also big dent to your pocket. To control that, there are some of the reasons mentioned below as why you should consider to get Personal Accident Insurance:

1.Different from the Other Products

A personal Accident Insurance is a product that is going to facilitate your need in the situation of injuries, disabilities and death that is solely caused by an accident.

You might be thinking that why it is different from the other products available with the insurance companies i.e. Medical Insurance. Medical Insurance comes with the limitations on the coverage of accident cases whereas Personal Accident Insurance entirely covers the cases that lie under the accident; Which is sufficient as accidental events can take place to any age group…

Check Jubliee Self Care Insurance for the list.

2. No Panel Restrictions

Thes hardest job after facing an accident is to get the best treatment for yourself/your loved ones. That can be done only in the hospital that you are assured off. Sometimes, Medical insurance imposes restrictions over panel. You can only go to the hospitals that fall under the panellist. Whereas there is no such restriction with “Personal Accident Insurance” You can call the helpline number of Jubliee General Insuranceand can get more information on this matter.

3. No Physical Documents are Required.

Submitting your documents to claim insurance coverage in such a crucial time is a burden of its own. But there is no such demand if you are aligned with Jubliee General Insurance.There is no requirement of physical documents if you are the customer of Jubliee General insurance’s “Personal Accident Insurance”

Criteria to Opt Jubliee’s Personal Accident Insurance

- Eligibility Age: 18-65 years

- Non-Filer Tax: A charge of 4% additional withholding tax on non-filers

- Premium: Premium and limits may vary by plan chosen

- Geographical Limitations : Pakistan Only

- Claims Payment) : All claims will be payable in Pakistani Rupees only

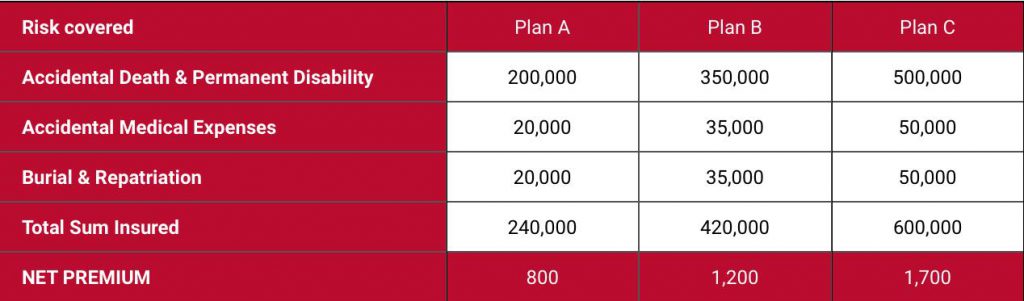

Plans Available

There are 3 types of plans:

- Plan A with a limit of PKR 240,000/-

- Plan B with a limit of PKR 420,000/-

- Plan C with a limit of PKR 600,000/-

This is a basic guide towards the Personal Accident Insurance. For further details, feel free to call SmartChoice for buying this policy or log on to Jubliee General Insurance

Have a safe time 🙂