Saving is one of the most important practices that every person should adopt in their life. The habit of saving money comes handy by trial and error. Saving is one of those topics which are least discussed when it comes to nourishment of sustainable cash flow.

Years ago, your grandfather must have gotten you a clay (pot) and asked you to put money in it and wait till it gets filled. You followed everything for the first few months and then you forgot about it. Now years later you’re sitting in your office, thinking about how you’re going to pay your next car Installment or maybe how you’re going to finance some amount in your sister’s wedding. Now that your pockets are empty and you’re in dire need of money.

Wouldn’t have been better if you never stopped saving? Saving is the subject that is not taught in our schools but it comes with practice. Your child needs to see the visualization of How Saving Money is Important.

Here are some of the tips which you can use to teach your child about saving money in an easy way at home:

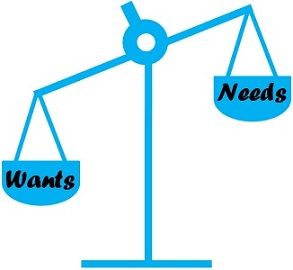

1. Start with the Discussion on Needs Vs Wants

The first thing your child should know before saving is the difference between needs and wants. A school-going child cannot understand this so quickly. Start with examples. Explain that need includes basic items e.g. food, shelter, clothes and wants are extra things such as toys, a summer trip or maybe a car. Start with making a small budget and this should give them the lesson that how needs should be prioritized first before wants.

2. Create Small Saving Goals for your Small ones

Teaching about saving money to your child without explaining and setting a goal to achieve goes of in vain. Start with explaining which you’ve already done above. Move forward by setting a small goal. A goal can be something that is easily understandable to your child as well as achievable. Set weekly goals. Set an amount that needs to be saved by the end of each month. Start with Rs.10 each say.

3. Let them Earn their Money

If you want your child to become a saver in future then let them earn their own money. Start paying them compensation for doing small house chores each day. Let say, allocate each day with one chore; 1. Make the bed, 2, Do your own dish, 3.Organize your toys and pay Rs 10 at the end of each day. In this way, you’re creating reinforcement for your child to save as well as making them responsible. One thing which you have to be sure about is that this reinforcement is not going towards the wrong direction and your child will always stand-up and assist you for the chores even without being offered with the money. Your child should also know the fact that things we do in life are not always done for money. Your child can consider these things as their responsibility.

4. Saving Incentive is a Game Changer…

One of the reasons why most of the employees in Pakistan accepts the offer of provident fund is the fact that they are going to have the additional amount which is going to be equal to the percentage deducted each month that we’ve served in a certain organization. You can use this same principle to keep your child in the game and motivated.

Let’s say your child wants to save Rs 4000 in one month. By setting a surprise incentive once your child reaches the halfway through would be a game-changer. You can add Rs. 500 once he reaches to Rs 2000. By doing this he is achieving the nearest number to the desired saving amount and that is what it is going to motivate him to run towards the finish line.

5. A Safe place to save…

As a beginner, your child is required to use a clay pot or saving jars to stash their cash. As they grow up, they will be required to have saving accounts. In this way, they can see how their money is moving and how the numbers are growing…Your child would be Super Motivated…

Having your own ATM card and a cheque book creates positive feelings about being grown-up where you just enjoy going Inside the ATM to operate his debit card and takes out cash. Signing your cheque for the first time can also make them feel responsible. This can also encourage them to save more so their hand can get on different options to retain their savings for as long as they want.

6. Let your Child track his saving

Saving money is not meant to be lying inside a jar for years. It is meant to spend at the right place at the right time. Your child should know what he or she is going to do with the money saved each month. You can follow some of the exercises. Ask your child to draw one thing which he would like to purchase.

Write down the price of the product on that drawing and cover one jar with the same drawing paper. In this way, your child can make small steps and can easily track that where did all the money go? This will help your child to make the right choices and prioritizing the things that they want first. Key Rule: One thing at a time.

Let’s wrap it up!!!

These are some of the tips which you can follow to create the urge to saving money in your kids. There are more of the options available which you can look up to, such as mutual funds or bonds. Where you can save for your child (Which you must be doing). The only way to teach your child regarding money matters is to do it by hand. Start it at a small level from your home and this will create a better understanding of your child to adopt this habit for his well –being in future. Don’t forget to lead by an example. Make Smartchoice so your child can do the same when it comes to saving money…