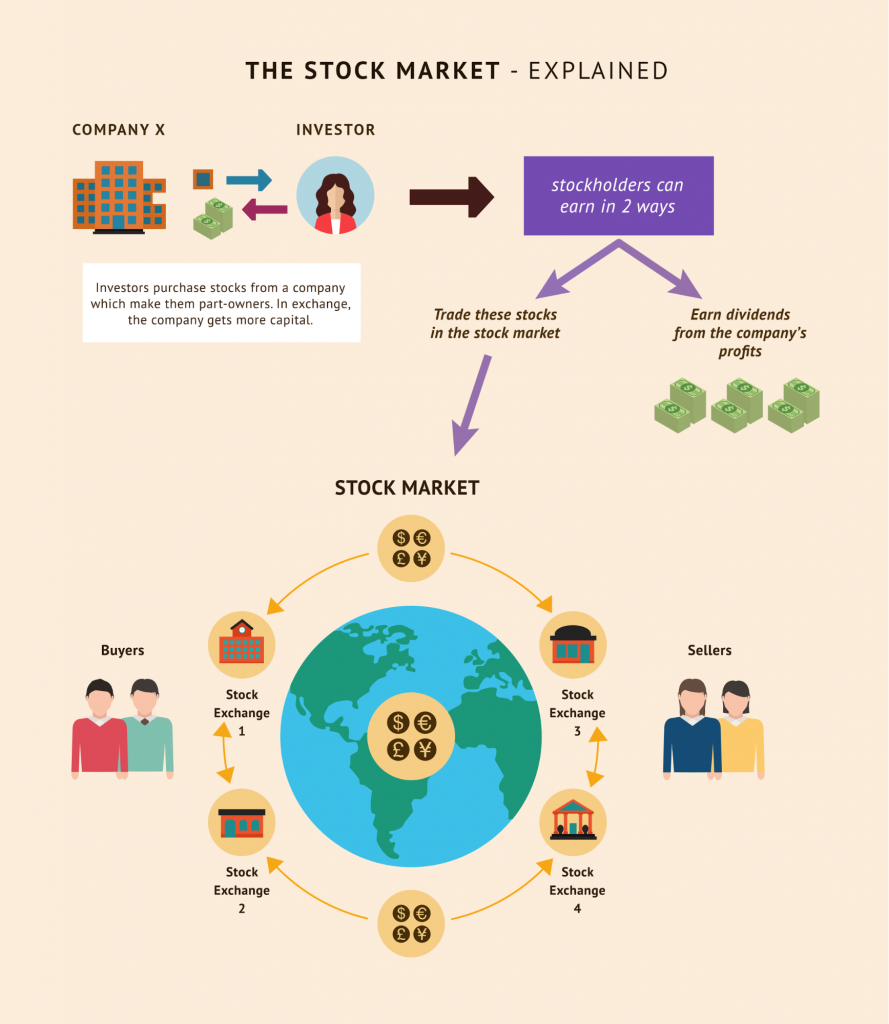

To get an understanding of the Stock Market, we need to know what stocks are and how they are traded.

What is a stock?

Stocks are the basic units of a company. If you own a stock, that means that you have a little part of the company. Being an owner of the stock of a company means that you are a part-owner of the company and, therefore, should be getting some part of the company’s profits and income.

Stocks have a specific value, which is usually Rs. 10, Rs. 100, Rs. 500, or even Rs. 1000 per share. This is known as the face value of the stock. This value is technically what the company should always have available.

Most stocks are issued at a price either above or below their face value. The stock is then traded in the stock market. People who are looking to earn from selling or buying the stock are called traders.

If the company is selling the stock for the first time, the issuance is called an Initial Public Offering or an IPO. It is called a stock issuance if it’s done it before.

Companies usually sell their stocks, which are also known as shares, to raise funds for the company. These funds help the company to run its business and buy machinery, plants, and other assets that would allow it to do business better. The money that it gets from selling stock can also be used for debt servicing, expansion, etc. The details of why the company is issuing stock are usually disclosed to some extent. They are specified in detail, particularly if the stock issuance is being done for the first time.

What is the stock market?

Stock markets are just that, marketplaces. People and companies that have bought or want to buy shares come to stock exchanges to sell and buy shares. Since there are many shares to buy and sell and many buyers and sellers, this entire process has become digitized, and most stock transfers are done electronically. Stock markets are also known as Stock Exchanges (since shares and money are exchanged)

The buyers for a specific share help to push its price up or down. For instance, if many people want to buy Google shares, the price of Google will increase, as the people selling Google shares will sell to a person that is paying the highest price. Stock markets only allow the buying and selling of shares that are listed on the exchange, for example, a stock listed only on the Karachi Stock Exchange (KSE) cannot be traded on the Islamabad Stock Exchange (ISE). People buy and sell stocks through specialized stock traders which are usually known as Stockbrokers or dealers

Stock markets can be of two kinds, the primary market, where companies issue their shares in an initial public offering (IPO) to raise funds for their operations. A general exchange is one where trades of already issued shares are made.

How Does the Pakistani Stock Market Work?

Pakistan’s Stock Markets work like most other markets globally. The stock market operates like an auction house or a trading floor in which buyers can bid on shares and buy at prices that they find attractive. If the price is too high, they pull away from the deal, and if there isn’t a good deal coming, the price is lowered. The buying price is called the bid, and the ask price is the one at which the seller wants to sell. Where the bid and ask prices are the same, a successful trade occurs.

This makes stock markets pretty much like traditional markets. The more a share is in demand, the pricier it would become. Similarly, if a share is not selling at a specific price, its price would continue to fall. This is the basic rule of demand and supply that determines market operations and ideally sets the prices of shares.

The stock market is different from other markets in the sense that it moves through the demand and supply cycle and price determination process at a very rapid pace. Such rapid changes in fluctuations of stock prices have led to most stock markets implementing ticks. Ticks are designed to keep price changes within specific ranges. This means that the price of a share cannot fall or rise beyond a specific minimum range.

Ticks serve to act as safety nets to protect investors from price crashes. Crashes occur when people start selling in a panic to limit their losses. This selling push begins to snowball, and a lot of people end up losing their money and investments.

How Does the Stock Market Affect An Average Investor?

The impact of the stock market performance and its rise and fall affects you, even if you aren’t an investor in shares and bonds. In rising stock markets, share prices tend to increase, and in falling markets, companies may need to cut jobs and try to reduce their overheads. This means fewer jobs and lower pay rates.

Falling stock prices and bond prices mean that pension funds are making lesser profits, and people lose money on their pension funds. The same applies to other saving funds and businesses as well. When stocks fall, there is less wealth to spread and spend.

Companies end up not getting enough money to spend on expansions and their operations. Retired people do not get as much pension from their funds as before, and overall, people end up having less to spend. This reduces income for smaller businesses and companies, and overall economic growth is affected. This reduces the spending for other consumer groups as well, and the slowdown of economic activity continues

A strong performing stock market is taken to symbolize economic well-being, and a dipped market over a long period causes an economic slowdown and sends out poor signals to investors.

Is Investing in the Stock Market Risky?

Placing your money anywhere, be it the stock market, the bank, under your mattress, or with your parents, is risky. There are different types and levels of risks involved, for instance, you or your parents can get robbed.

When you invest money in the stock market, the profit you will make is not fixed. The earnings will depend on the selling price of your investments on the day and hour in which you will sell them.

This means that you face the risk of the price being lower than what you bought and losing some of your hard-earned money. This means that as an investor in the stock market, you must follow the prices of your investments and make sure that they are progressing upwards. If they are falling steadily and there is negative news that seems to be continuing, you should think about cutting your losses and pulling out your money.

Another risk that affects the stocks and their investors directly is inflation. Rising prices and lowering demands means that the economy is losing its value as the actual buying power of the currency falls.

This makes investments lose their value as their actual buying power reduces. Investors in fixed return options like mutual funds end up getting less than their money’s worth. The best way to avoid risk is to follow the markets, and make sure to set your benchmark ranges in which you want to remove your investments so that you don’t lose too much of your investment.

How Can I Make Money in the Stock Market?

People earn money on the stock market in two ways. One way is through price appreciation.

You buy a stock for Rs. 50, and it goes on to rise to Rs. 75. If you purchased 100 shares at Rs. 50, this makes your investment worth Rs. 5,000. When you sell these 100 shares for Rs. 75, you earn Rs. 7,500. This means that you earned Rs. 2,500 from this transaction.

The example above gives you a profit rate of 50%. This is much above what any other means of investment would provide you. Even if the example is a little extreme in terms of the gains made, many investors do make such profits through a serious focus on market trends and share prices. This method requires continued monitoring of the stock market and related developments to follow price trends.

The second way to earn money is through dividend earnings. In this method, you invest money in shares, which you know will pay good returns to their shareholders. Dividends are a part of a company’s income that it pays to its shareholders.

This method involves identifying and investing in companies that have records of paying good dividends and then accumulating a portfolio of such shares. A portfolio is a group of shares that you own. It is commonly called an investment portfolio.

This method of earning from the stock market is a long-term method and usually involves less trading. This is more of a hold and earn approach and is generally adopted for the long term. When a publicly listed company pays dividends to its shareholders, that adds value (and income) for the shareholder.

When stocks increase in price and are trading at more than what the shareholder paid, that’s a positive outcome.

How can I make money in the stock market?

As a beginner to the stock market, it is always advisable to remember that the markets will always trend upwards. However, this does not at all mean that the shares in the market will also move upwards; many will fall and die off. The stock markets are notorious for their unpredictability and volatility. Seasoned traders and experts also lose on their investments despite all their technical skills.

So for a new investor, it is best if you go for index funds. Index funds are funds that select some stocks from a specific stock market, and they follow these stocks. Some index funds issue dividends as well. The advantage of such index funds is that they will follow the stock market in its rise upwards and help you to increase your investments as well. But this strategy is going to be effective in the long run.

Avoid the dream of making a few hundred thousand in a few months. Invest in middle-market stocks if you can otherwise opt for funds and shares that are known for paying out good dividends. This means that you look for companies with good profitability and sound leadership.

Don’t go for market darlings and overhyped companies. Follow the price-to-earnings ratio (P/E). P/E is a formula that gives the value of a stock. It has its shortcomings but would give you an idea of a share’s worth. You can also follow the growth in earnings of a company to gauge its attractiveness.

How do I get started investing?

The younger you are when you start, the more you will make from your investments. There are some necessary steps to take, which are more like habits to form and stick to. Set an amount that you can set aside for investment for a month and stick to it.

Figure what your goals are and what you want to do with your investment income. Travel the world? (short term goal), set up a college fund for your kids? (Long term goal), do you want to buy a house? (medium to long-term goal). Having your financial priorities sorted will help you identify what sort of returns and time frame you have for your investments.

Figure out what works for you. Do you want to track share prices and follow market trends rigorously? Or do you want to be a passive investor and get returns over the long run, without moving your investments around too much?

If the first option suits you, then you want to be an active investor. These are investors that do active trading and ride trending share prices and try to get the maximum return out of the stock market fluctuations.

If the second option suits you, then you are set to become a passive investor. In such investments, the majority of holdings are in index funds and mutual funds. These funds help to mitigate the risks and cut down the stock market volatility.

The key to both strategies is to avoid placing your investments in limited sectors of the economy and spread them into diverse sectors to ensure that at a time, any one of your investments would be doing well.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.