Financial security is more crucial than ever in an increasingly economically volatile world. Unexpected expenses, from medical emergencies to a sudden job loss, can destabilize even the most meticulously planned budgets.

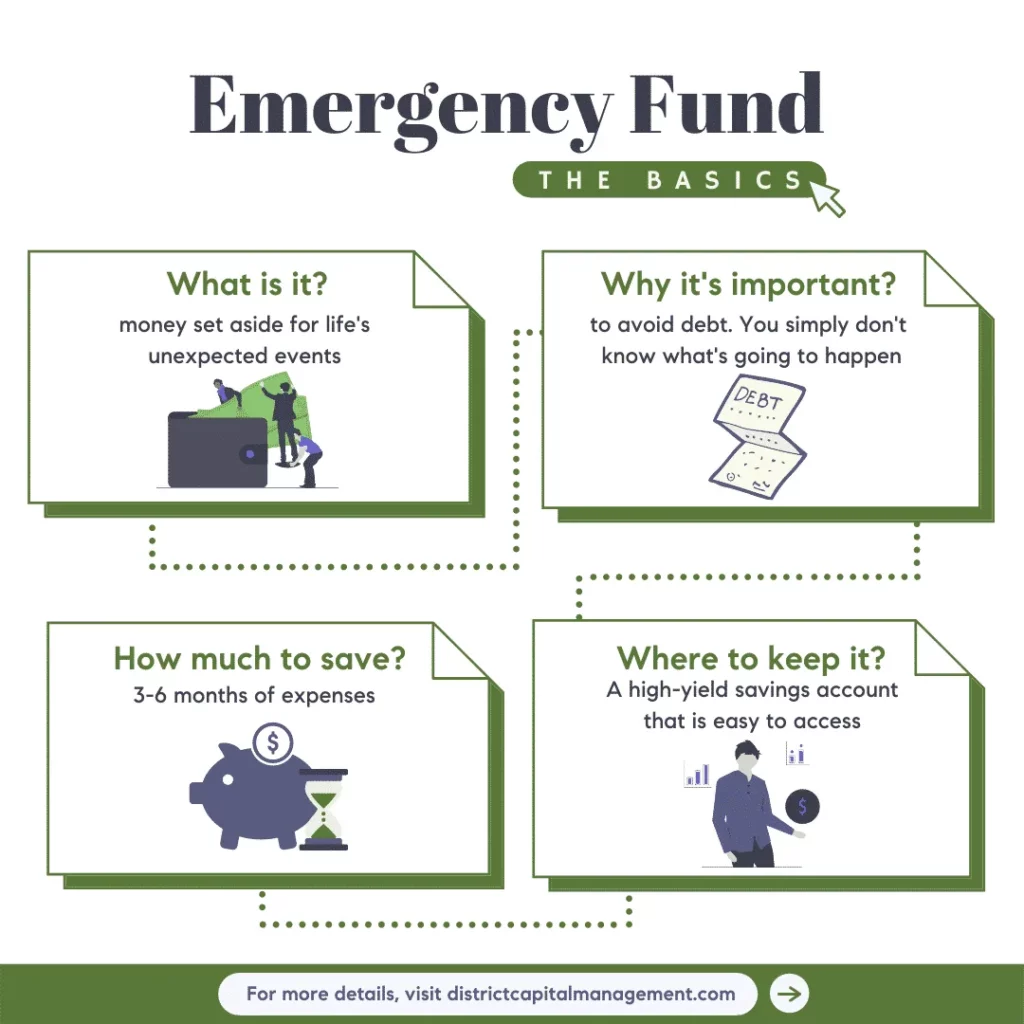

This is where an emergency savings fund comes into play. An emergency savings fund is a financial safety net designed to cover unforeseen expenses, providing peace of mind and financial stability. In this blog, we’ll delve into why an emergency savings fund is essential and how you can build one effectively.

Why an Emergency Savings Fund is Essential

1. Protects Against Unexpected Expenses

Life is full of surprises, some of which can be financially draining. Car repairs, medical bills, or home maintenance issues can arise unexpectedly. Without an emergency fund, you might find yourself relying on credit cards or loans to cover these costs, leading to debt and financial stress. An emergency fund ensures you have the resources to handle these expenses without disrupting your financial stability.

2. Provides Financial Security During Job Loss

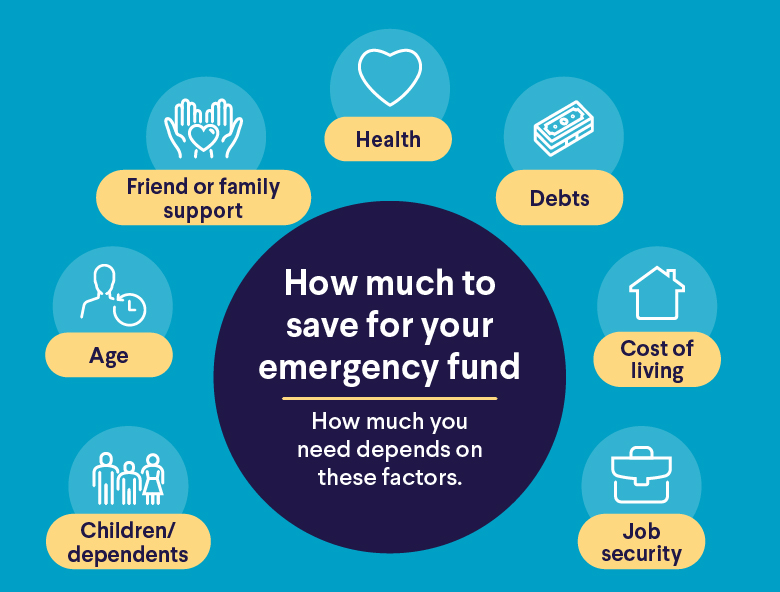

Job security is never guaranteed. Economic downturns, company restructures, or personal circumstances can result in sudden unemployment. An emergency savings fund acts as a buffer, allowing you to cover living expenses while you search for a new job. This financial cushion can help reduce the pressure and allow you to focus on finding a suitable position without the immediate fear of financial ruin.

3. Helps Maintain Your Standard of Living

During financial crises, maintaining your standard of living can become challenging. An emergency fund helps you manage day-to-day expenses without compromising your lifestyle. It enables you to continue paying bills, buying groceries, and covering other essential costs without resorting to high-interest debt options.

4. Reduces Financial Stress

Financial uncertainty can cause substantial stress and anxiety, which affects both mental and physical wellbeing. Knowing you have an emergency fund to fall back on can provide peace of mind, reducing stress and allowing you to focus on other important aspects of your life.

5. Avoids High-Interest Debt

Without an emergency fund, you may resort to credit cards or personal loans to cover unexpected expenses. These options often come with high interest rates, which can quickly escalate your debt and create a vicious cycle of borrowing. Having an emergency fund is effective in avoiding high-interest debt and helps to control your finances.

How to Build an Emergency Savings Fund

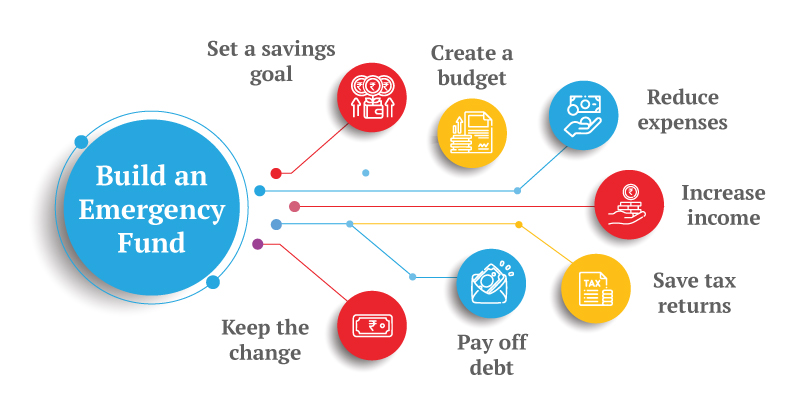

1. Set a Savings Goal

The first step to setting up an emergency fund is deciding on a savings goal. Financial experts usually recommend saving an amount that covers living expenses for three to six months. This provides a sufficient cushion to cover most emergencies. Calculate your monthly expenses, including rent or mortgage, utilities, groceries, transportation, insurance, and any other essential costs, to set your savings goal.

2. Create a Budget

A well-structured budget is crucial for saving money. Record all your income and expenses to see where your money goes each month. Identify areas where you can reduce or at least eliminate unnecessary spending. Redirect these savings to your emergency fund. Consistently reviewing and adjusting your budget can help you stay on track and reach your savings goal faster. For more details on budgeting, visit Managing Income in Pakistan: A Guide to Budgeting Money and Expenses.

3. Automate Your Savings

Automating your savings is one of the most effective ways to build an emergency fund. Set an automatic monthly transfer from your salary account to your savings account. This ensures you consistently contribute to your emergency fund without having to think about it. Treat your savings contributions like any other bill, making them a non-negotiable part of your budget.

4. Open a Separate Savings Account

To avoid the temptation of spending your emergency savings, consider opening a separate savings account dedicated solely to your emergency fund. A high-yield savings account can be a good option, as it offers higher interest rates, helping your savings grow faster. Keeping your emergency fund separate from your everyday spending accounts can also make it easier to track your progress.

5. Start Small and Build Gradually

Setting up an emergency fund can seem daunting, especially if you’re starting small. But every savings and budgeting help site will give you the same advice. Begin with small, manageable contributions and increase the amount gradually over time. Even saving a small percentage of your income each month can add up significantly over time. The key is to remain consistent and committed to your savings goal.

6. Cut Back on Non-Essential Spending

Find non-essential expenses that you can cut or remove temporarily. These could be your weekly dining out, less-used subscription services, or a monthly shopping trip. Divert the money you save from cutting on these expenses towards your emergency fund. Making small sacrifices now can lead to significant financial security in the future.

7. Earn Extra Income

Consider finding ways to earn extra income to boost your emergency savings. This could be taking on a part-time job, freelancing, or selling items you don’t need anymore. Any additional income you earn can be directly added to your emergency fund, helping you reach your savings goal more quickly.

8. Review and Adjust Regularly

Review your emergency fund progress regularly and adjust your savings plan as needed. Life circumstances can change, and your savings goal may need to be updated accordingly. Periodic assessments help ensure that you stay on track and make the necessary adjustments to your budget or savings strategy.

Conclusion

An emergency savings fund is crucial to financial security, providing a safety net for unexpected expenses and protecting against financial stress. By setting a savings goal, creating a budget, automating your savings, and consistently contributing to your fund, you can build a robust financial cushion to safeguard your future. The key to saving successfully is consistency and commitment. Start building your emergency fund today to ensure peace of mind and financial stability in the face of life’s uncertainties.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.