Life is full of uncertainties and these uncertainties sometimes give us the best of chances to shape our lives the way we want. We desire the best for us and our loved ones, but the unforeseen is something beyond our control. One would never imagine a medical emergency in their family. But the truth is that it does strikes at some point in your lives; If not now then probably later. How do you drive your way out then? What should you do in such cases? Being a salaried employee, not having enough funds in hand at such a time may leave you feeling absolutely helpless.

Jubilee General Insurance Health insurance comes forward to our rescue in a scenario just like this. They protect you from the unforeseen medical risks so that financial worry is the last thing on your mind. Health insurance becomes extremely critical, given our modern lifestyles and the uncertainties that we are exposed to on a daily basis. Also choosing a correct health policy can be a fairly tedious process and it needs utmost attention; so as to avoid overlooking the important aspects.

Knowing the right insurance plan amongst the wide variety available in the market; suiting your needs is very important. The insurance plan would differ depending upon the number of members to be insured, the age of the insured and the diseases to be covered.

1. Plans Available

You need to keep your options wide open once you’ve decided to go for health insurance for your family. Sometimes the insurer you trust doesn’t provide you with the plans that are well suited to you and your family members. In this situation, you need to see that the plans that are in the offer should match your desires. Just so you know Jubilee general insurance provides ‘Benefit Product Table’ that provides Hospital/Surgical & Miscellaneous expenses. Some of the covered expenses are In-Hospital Consultations, Intensive Care Charges, Surgical Fees, Anaesthetist’s Fee, Operation Theater Charges, Prescribed Medicines, Diagnostic Investigations, Blood & Oxygen Supplies, Ventilator & Allied Services, Daycare procedures including Kidney Dialysis/Chemotherapy & Radiotherapy for Cancer.

2. Categories

The policy you are going to choose should be consider on the categories it is providing. Ideally there are three categories that are usually provided by insurers:

1) Platinum 2) Golden 3) Silver

Jubilee general insurance covers two categories from above and provides private and semi-private rooms as per plan and category.

3. Coverage

Choosing of a viable plan for you and your family is depended upon the coverage of options in that policy that not just only should suit to your pocket but should also cover an appropriate combination of situations. In Jubilee general health care insurance for your family, Hospitalization limits are annual and allocated on ‘Per Family’ basis. Jubilee General Insurance is offering two exclusive plans with following annual family limits, i.e.,

Silver Plan: Rs. 275,000

Gold Plan: Rs. 550,000

Product Packages are as follows:

I. Family ‘A’ – Self, Spouse & up to 02 children

II. Family ‘B’ – Self, Spouse & up to 03 children

III. Family ‘C’ – Self, Spouse & up to 04 children

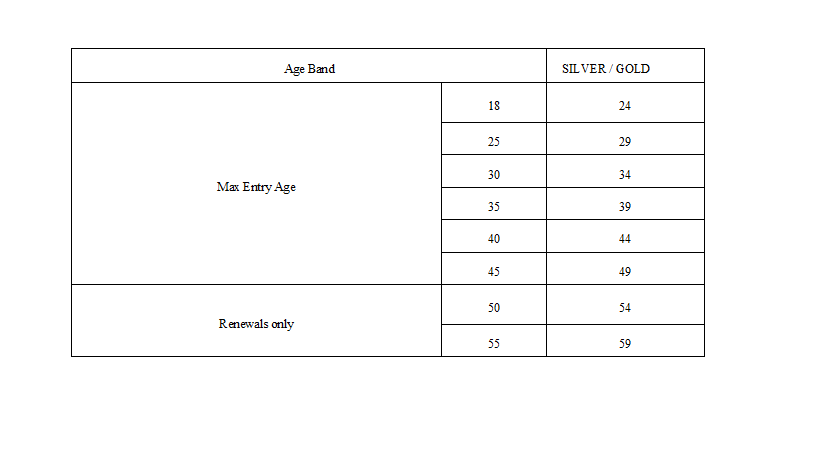

4. Age and Cost Correlation

Age is the most important factor when it comes to your premium calculation. Some policies provide options that are age-friendly as well as cost-effective. In Jubilee, general insurance following are the points to be noted:

Entry Age: Proposer/ Spouse- 18-49 (Once covered, the policy can be renewed yearly till age60).

Children: 1 year -23 years.

Single premium covers a family of maximum 06 (self + Spouse + up to 4 children)

Family Premium: Will depend on the age (next birthday) of the eldest member and the package premium will cover a maximum of 06 persons-Self, Spouse and 04 Children.