The primary aim of investing is to build up your savings. Small scale investors can achieve this goal through investments in different assets like shares, savings certificates, and other less common options.

More experienced investors invest in commodities like foreign currency, gold, and crypto. All investment options can give good gains but have risks associated with the investment. To avoid risks in any form of investment, you should make it your goal to have a diverse spread of investments.

In case you are just starting on your portfolio building journey, you have to make sure that you pick options that include both low risk (fixed deposit certificates) and high risk (shares). Doing this will allow your portfolio to cover both high and low-risk investments.

Risks in Investment

However, not everyone is skilled enough to invest in any of these options without incurring some losses. Many people just do not have the time or strong enough nerves to invest in any asset directly.

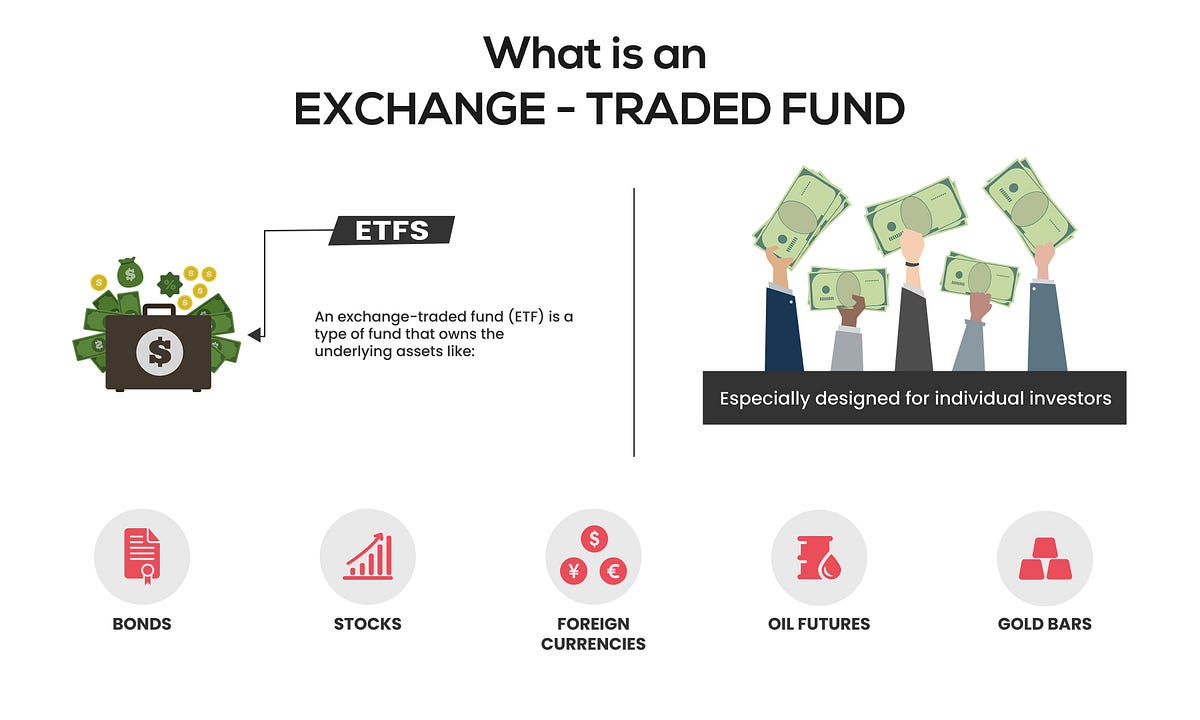

If you are such a person or have already faced losses in your investment and don’t want to risk-reducing your savings further, you can opt for the low-risk options available. These fund options will help reduce your risk and offer a comparatively stable investment growth over time. The two most common investment options in funds are mutual funds and exchange-traded funds (ETFs). We will discuss ETFs in detail.

What is an ETF?

An Exchange Traded Fund (ETF) is an investment product offered by Asset Management Companies (AMC). It consists of a mix of securities that follows an index (which is called its Benchmark Index). ETFs are available to investors on Stock Exchanges through stockbrokers (TREC Holders). They can be traded like stocks with real time pricing during trading hours on an Exchange. Therefore, they share the characteristics of both open-ended mutual funds and stocks.

Internationally, the demand for ETFs is growing because of the convenience they offer and the lack of financial acumen (and time) on part of the investors to make successful stock picks. Similarly, retail investors are also wary of paying hefty fees to financial advisors and traditional mutual funds which leads them to invest in ETFs.

If you want to invest in equity or fixed income securities and find it challenging to pick sectors, identify securities, conduct research, track dividends/coupons, and capital gains, then the ETF does it all for you. An ETF aims to track its specified benchmark index while providing real time price of the fund throughout the trading time.

An ETF can have tens of stocks across various industries or it could be isolated to one particular industry. For example, a banking-focused ETF would contain various stocks from the banking industry. An ETF can also track an existing index like the KSE – 30 indexes etc.

How to Invest in an ETF?

Investors can buy and sell ETFs in the stock market through a stockbroker of the Stock Exchange. A new investor will need to open trading (brokerage) account with any of the PSX TREC Holders or brokerage firms.

An existing investor in the stock market can buy and sell ETF units through their existing trading (brokerage) account with any of the PSX TREC Holders.

ETFs can be bought with a very small amount. In the odd lot market, even one ETF unit can be bought or sold, whereas in the regular market, the ETFs can be traded in a lot size of 500 units.

ETFs Explained

An exchange-traded fund (ETF) is a mutual fund that invests in securities linked to a particular index. Investing in an ETF offers exposure to a group of stocks. Instead of dealing with individual stocks, you can get multiple shares through a single ETF investment.

The stocks in an ETF are selected based on its investment criteria. ETFs can have different investments like stocks, commodities, bonds, or a mix of these types. Again, these are pre-specified, and you won’t be shocked, provided you read their investment documents thoroughly.

ETFs differ from mutual funds because they can get registered on stock markets and are bought and sold there like ordinary stock. ETFs can be traded through both online brokers and the usual broker-dealers.

Assets Under Management:

For an ETF or a mutual fund, assets under management (AUM) are the current trading prices of all the investments it handles on behalf of investors. It is a factor like the capitalization of a company. AUM shows the fund’s size, and generally, higher AUMs mean higher trading volumes and imply better liquidity. The AUM is used to calculate management fees and other charges.

Benefits of Investing in ETFs

ETFs have lower operating costs than traditional open-ended funds, and they offer flexible trading (unlike mutual funds) and have greater transparency as they are mandated to disclose all their holdings.

An ETF is a simple and efficient way to invest in the stock market without going into the hassle of investing and researching individual stocks. By investing in an ETF, your investment is instantly diversified across all the underlying securities in the basket.

ETFs provide an easy way to diversify across different stocks, commodities, bonds, or other securities in the markets where many ETFs across multiple asset classes exist.

ETFs can yield two types of returns:

Capital Gains:

Investors can trade ETFs like a stock by buying them at a low price and selling it at a high price to realize the profit/gain.

Dividends:

The fund manager receives dividends from the securities that comprise the ETF basket. The dividends may be distributed to ETF unit holders after the deduction of management fees etc. The dividend distribution policy of the ETFs is described in their Prospectus or Offering Document.

Individual stocks and ETFs trade alongside each other on the Stock Exchange. But there are two major differences:

- ETFs are generally much more diversified as they are comprised of a basket of stocks.

- Most ETFs track specific indices, while stocks do not.

Better is a relative term; investing in ETFs is generally better from the diversification perspective.

Why it is Smart to Invest in an ETF

ETFs are generally passive instruments formed to track an index. ETFs provide real-time pricing. This means that investors can see their prices change throughout the trading day like those of shares. ETFs are bought and sold at market price through a brokerage account and offer intraday trading liquidity. The price of ETF can be above (premium) or below (discount) the respective NAV. Investors also have the benefit of having Indicative NAV available at specified times during the trading hours to help them make trading decisions.

Comparatively, a mutual fund isn’t priced until the trading day is over. When encashing, you buy the mutual fund units directly from the mutual fund at its respective Net Asset Value (NAV). Investment in mutual funds can be subject to front-end or back-end load/sales charges, while investors in ETFs only have to bear brokerage charges.

Being a passive investment option, ETFs are great for long-term investments. This is subject to your investment objectives, considering factors like risk and return goals. Most ETFs track an underlying index, and as the index updates, so should the ETF.

Investing in ETFs also saves the investor time and money. Investors do not have to do the research and make security-specific investment decisions themselves. The costs for the ETF are also generally lower than those of any mutual fund units purchased.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.