Branchless banking is defined as the delivery of financial services outside conventional bank branches, often using agents and relying on information and communications technologies to transmit transaction details. Typically, point-of-sales (POS) terminals or mobile phones. It has the potential to radically reduce the cost of delivery and increase convenience for customers.

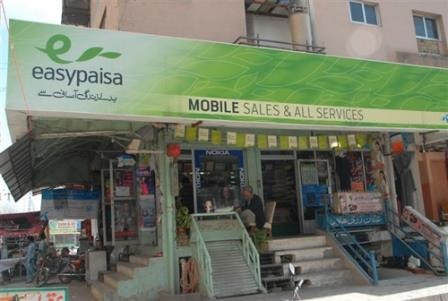

In Pakistan, branchless banking has also taken great strides. People have multiple options by various telcos and banks. People from rural areas prefer using mobile financial services due to lack of literacy and complex procedures, to send back money to their homes after working in the cities. Even in urban areas, it’s considered as a fast and instant medium of money transfer and thus people consistently use it to send money to each other. The other way mobile money services have been used is by telcos offering to open mobile wallets against your phone numbers and thus getting an account in which you can deposit money to be used later for making payments such as utility bills. Telcos have also now started to offer vending machines filled with edible goods to businesses and other public & private institutions that use NFC enabling smartphone users to tap-and-pay from the mobile money wallets thus enabling a cash free transaction environment.

Even with all this, the true potential of branchless banking, especially mobile wallets remains untapped. Recently telcos have started partnering with e-commerce websites to give discounts on purchases from various online sale events if you use your mobile wallet to pay for the product which has seen alot of positive response. Payments are escrowed and only disbursed to seller after product has been delivered to buyer hence buyer is also safe from scams or faulty fraudulent products. Also some telcos are now giving life insurance against maintaining a specific amount in your mobile wallet account which is another good service to entice consumers across Pakistan to start using mobile financial services.

However there’s few other places where branchless banking and mobile wallet solutions can prove to be extremely successful and could further accelerate the adoption rate. These mediums of payments can be between the following:

Government to People (G2P):

This is one of the most important applications of the mobile financial solutions as senior citizens could get their pensions while sitting at home without having the need to visit different offices or having to stand and wait in queues, thus making it easier for the authorities as well to disburse pensions in an efficient manner reducing the hassle of delayed payments.

In another scenario, during natural disasters, donations can be done through mobile wallets where people willing to donate can simply punch in a short code to send in their donations to a centralized authority after which the amounts could be spent on relief efforts and supplies without the fear of embezzlement during collection.

Lastly, services offered by government institutions such as National Identity Cards, Passport and Driving License fee, Motor Vehicle Registration and Tax payment and Hospital bills can be paid for via mobile financial services if implemented thus clamping down on bribery and corruption rampant in government organizations.

People to People (P2P):

Currently, people can send money to each other via an agent over the counter. However to further promote usage of mobile wallets, service providers should enable inter-wallet transfers as well so that the hassle of visiting an agent each time for sending money is eliminated. Also since the phone number is the account number, there’s nomore the worry of having to remember complex account numbers thus facilitating the consumer greatly.

Furthermore, to accelerate the adoption and usage of mobile wallets. Service providers should target areas where micro transactions take place. For e.g vendors in commercial areas should be reached out and encouraged to take up mobile wallet solutions. Each vendor can be assigned a merchant ID that can be displayed prominently and buyers can do instant transfers from their money wallets to the merchant against the items purchased. This would also minimise theft of robbery as less cash would be present in the shop at any times once this service picks off. It’s pertinent to mention here that M-Pesa, a mobile wallet service in Kenya is running on the same concept successfully. This will also help people to manage their daily expenditures in a smarter way. Once micro transactions have been covered only then any mobile wallet service would prove to be widely adopted in macro level transactions as well. In Pakistan some banks have started offering mobile wallet services such as HBL, UBL, MCB and Meezan Bank.

SBP and SECP should also work on making branchless banking services to be economical and any service charges or taxes should be lesser than conventional banking to make it enticing for the general public.

With the implementation of these features and services along with proper awareness, we believe that branchless banking and especially mobile money wallets have a bright future ahead!