Investing is a process through which the investor (the person investing) puts some money aside to earn more money. The theory is that the money works for you without getting involved and growing. The objective is to increase the money you have.

What Kind of Investor Are You?

Before you decide to invest money someplace, you need to know what type of investor you are. This means that you figure out how much risk you’re willing to take. This is because most investment choices have some risk. Risk can be seen as the chance of losing your original money, which is also known as your capital. Some people are not willing to have their capital at risk at all. This is known as being risk averse. Others are very comfortable with risking their money if there is a prospect that they can gain more in time. Most of us have risk preferences that fall in some range between these two extremes.

Most investment choices are categorized according to their risk level. For example, many people see Defence and Special Saving Certificates as safe investment avenues in Pakistan. Similarly, the stock market is riskier and more prone to manipulation.

As a new investor, it is up to you to decide what risk levels you are more comfortable with. standard options through which you can invest are as follows:

1. Investing through your employer

One of the safest options for investment can be to simply ask your employer to deduct an extra percentage of your salary into the retirement plan offered by your employer. This is an effortless and safe way of investing money with minimal hassle. Once you get used to this extra deduction, you won’t even feel its absence.

Most work-based retirement plans deduct your contribution before taxes, making it even more convenient. The charm is that you can continue to increase this deduction as your salary increases through promotions and annual raises.

2. Investing in stocks

A stock is an ownership unit in a business that gives the person ownership rights. Stocks are also called shares. A person holding stock in a company is the shareholder of that company. Most companies issue stocks to generate money for their businesses. Investors can buy and sell shares on stock exchanges or markets to earn profit from price fluctuation or dividends.

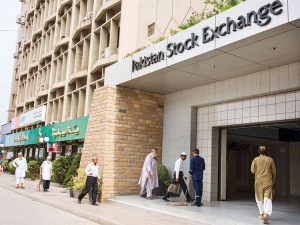

· What is a Stock Exchange?

A Stock Exchange is a specific market where you can buy or sell stocks. Units of stock are called “shares.” You can buy shares from companies, use them for investment and sell them again, in turn making a profit. A Stock Exchange allows complete anonymity of the person on the other end of the trade.

· How does it work?

Stock Exchanges work the same way globally. A business raises money (known as capital) by issuing shares. The people who buy these shares usually plan to sell them someday. This selling (and buying) will be done through the Stock Exchange. Others buy shares to earn dividends from the shares.

The Federal Board of Revenue claims that there are roughly 300,000 registered stock traders under the Sales Tax Act. in comparison, the National Clearing Company of Pakistan (NCCPL) stated in April 2021 that about 250,000 are listed as earning from their trading activities.

· What are Dividends?

The company issues dividends to its shareholders. It is a part of the company’s profits given to the shareholders as payments. Most companies do not guarantee dividends, and they can vary year to year.

· Types of Investments in the Stock Market

Two types of investments can be made on any Pakistani Stock Exchange:

i. Short Term Investment:

In short-term investment, the investors buy and sell shares frequently based on the market price. They do so by their skill of analyzing the pricing projections of stock prices. The principle is to buy at low prices and sell as soon as the price rises.

ii. Long Term Investment:

In long-term investments, the investors keep their shares for an extended period. Ideally, they earn dividends and hold the share until the prices reach their peak to maximize profit.

Things to Remember when investing in Shares

When we buy a product, we usually have a list or know what we want to buy, where to go, and which shops to browse. The same applies to investing in the stock market.

You have to do a lot of research into sectors, companies, and their performance history to know which stock performance and valuation fits into your investment preference or risk appetite.

The main factors that influence the pricing for stocks are the financial data related to the company, the state of the industry in which the company is working, the interest rates offered by banks, and investor sentiments.

Financial information is available in financial statements issued by the company every quarter. They give investors insight into the financial situation of the company. However, understanding financial statements can be tough for even experienced investors.

Investing in stocks can be rewarding, but not everyone is fortunate enough to pick performing stocks and earn good returns. There are other options for people who find the stock market too complicated for their comfort.

3. Mutual Funds

Mutual Funds are a form of stock investment that is less risky and more convenient. A mutual fund collects money from multiple investors to invest in securities like stocks, bonds, money market instruments, and other assets. The investment options for a mutual fund are predefined and available for everyone.

Mutual funds offer an edge to investors as they offer a diversified portfolio, which professionals manage for a specific price. This price is known as the management fee.

Assets under management (AUM) is the market value of all investments that the fund handles on behalf of investors. AUM shows the fund’s size, and generally, higher AUMs mean higher trading volumes and imply better liquidity.

Mutual funds are considered more advanced and less risky than stocks as they place the investors’ capital in a combination of shares, bonds, and even real estate. They are less risky because of this.

How It works

As an investor, you buy the mutual fund in units and earn a profit or grow your investment, depending on the type of mutual fund you invest in. You can shop around for a fund that you find suitable.

You can also invest in multiple funds covering foreign securities or industries. Mutual funds give returns in dividends, coupons, or even profits, depending on the type of assets they invest in.

The mix of investment choices is known as asset allocation. For an individual, asset allocation involves splitting the investment funds among various assets, like stocks, bonds, and cash.

4. An Exchange-Traded Fund (ETF)

An exchange-traded fund (ETF) is a form of mutual fund that invests in a group of securities linked to an index. The stocks are selected based on the ETFs investment criteria.

ETFs can have different investments like stocks, commodities, bonds, or a mix of these types. ETFs are separate from mutual funds as they are listed on exchanges and can be traded there like ordinary shares.

Investing in an ETF gives exposure to a group of stocks. Instead of dealing with individual stocks, you can get multiple shares through a single ETF investment.

For an ETF, assets under management (AUM) are the market value of all investments that it handles on behalf of investors. AUM shows the fund’s size, and generally, higher AUMs mean higher trading volumes and imply better liquidity.

The process of settling on a mix of assets to invest in is a very personal one and usually depends on your investment goals and your age when you start investing. Opting for a mutual fund or an ETF simplifies the decision-making process.

Investment Strategy

An investment strategy is used to select what securities you will invest in. These strategies are made according to your risk appetite and saving preferences. This means the amount of risk you are willing to take on your money when you want your capital back and an estimate of how much you want to increase it.

In theory, your investment strategy determines which securities and investment avenues you will place your funds. Many younger investors, who have the funds and can take risks, invest in riskier investments since they can afford to gamble with their funds, as they have less responsibility and can take the shock of losing (some of) their capital.

Ultimately, you have to assess yourself to see why you are investing. Are you looking to get a secondary source of income through investing? Or do you want to build another house for rental income? Do you want to save up money for your children’s future? The reasons can be diverse.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.