The Asaan Account is focused on the common people. It is available to all low income unbanked/under-banked people who face difficulties in account opening due to complicated account opening requirements or lesser means of access. It particularly focuses on the low income segments of the population and women from all segments who do not operate their accounts due to limited mobility, excessive documentation, and lack of accessibility to traditional banking avenues.

To learn about Asaan Mobile account in urdu, watch our video.

The Asaan Mobile Account is a recent launch by the State Bank of Pakistan (SBP). The account has been introduced in partnership with Pakistan Telecommunication Authority (PTA) and, National Database and Registration Authority (NADRA) from the public sector and the main branchless banking providers and telecom companies from the private sector. The account is an initiative under the National Financial Inclusion Strategy (NFIS) to facilitate people that do not currently have a bank account.

It targets the general masses, especially the low-income segments, to support their financial inclusion into the digital economy of Pakistan.

Facilities of Asaan Mobile Account

Asaan account holders can deposit money in their account from any branchless banking agent and use this account for banking transactions through their mobile phones. Asaan account facilitates opening a branchless banking account by simply dialing a code (*2262#) on a mobile phone. A smartphone is not necessary to operate this account.

People looking to open their Asaan accounts have the choice to select a ‘bank’ of their preference from any of the 13 branchless banking service providers that are currently offering Asaan account facilities.

Who can be an Asaan Account Holder?

Anyone Pakistani national above 18 with a valid CNIC can open their Asaan Mobile Bank Account (AMA) from any participating bank through their mobile number.

The Asaan account scheme allows individuals to contact the AMA platform by dialing a short code, i.e., *2262#, from their cell phone and make transactions. This process is not dependent on the user having a smartphone or access to the internet, which makes it useful for the lower income segment and women in particular.

Asaan Mobile Bank Account Facilities

Send Money: Transfer funds safely to any local bank account maintained at any Pakistani bank from your phone.

Mini Statement: Get the account activity statement online immediately from your phone.

Bill Payment: recharge your mobile balances, easily pay utility bills like electricity, telephone, gas, etc., from your phone.

Balance Inquiry: Find your account balance in your account directly from your phone.

Change Account PIN: Safely change the PIN code for your bank account securely with ease from your phone.

Account Closure: Asaan Mobile allows for instant account closing from your phone.

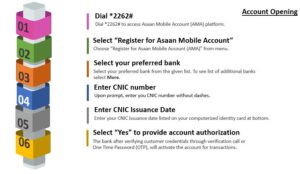

How to open Asaan Mobile Account?

Step 1:

Dial *2262# to connect to the Asaan Mobile Bank Account (AMA) platform.

Step 2:

Select the ‘Register for Asaan Mobile Account (AMA)’ from the menu.

Step 3:

Choose the bank you want to join from the given list. To see the complete list of banks, click on ‘select more.’

Step 4:

Type in your CNIC number without any dashes between the numbers.

Step 5:

Enter the date of the CNIC issue listed at the bottom of your Computerized National Identity Card (CNIC).

Step 6:

Select ‘Yes’ to initiate account authorization. The bank will verify the customer credentials provided by either a verification call or sending a One Time Password (OTP) to your phone. Feeding this OTP in the platform will activate the new account for transactions.

How to link an account to Asaan Mobile Account?

People that want to link an existing bank account to an Asaan Mobile Bank Account can follow thesesteps:

Please remember that a customer can only link one account to their Asaan Account.

Step 1:

Dial *2262# to connect with the Asaan Mobile Bank Account (AMA) platform

Step 2:

Select ‘Request to link existing bank account’ from the options. The user can choose to open a new account or link an existing account. There is a restriction of linking one account per user.

Step 3:

Pick your bank from the list provided or select more to see a list of other banks.

Step 4:

Enter your account and CNIC number without any spaces or dashes.

Step 5:

Enter your account pin to link it to your Asaan account.

Step 6:

Pick ‘Yes’ to give account authorization. You will get an SMS on successful linking on entering your account pin number (PIN).

Process of sending money through Asaan Mobile Account?

Step 1:

Dial *2262# to connect to your Asaan Mobile Bank Account.

Step 2:

Select ‘Same Bank’ if the person you are sending money to has an account in the same bank as you or ‘Other Bank’ if their account is with another bank.

Step 3:

Select ‘Receiver Bank Name’ from the list of banks or select more to see the other banks.

Step 4:

Type the account number of the receiver.

Step 5:

Type in the amount that you want to send.

Step 6:

You will be asked to provide your bank account pin to confirm the transaction.

Advantages of the Asaan Mobile Account

The purpose of the Asaan Mobile Account is to bring more people into the digital financial inclusion in the country.

The Government is currently implementing the National Financial Inclusion Strategy target of promoting financial inclusion of the underbanked population of Pakistan. Pakistan has over 187 million mobile subscribers verified biometrically. This makes Pakistan have a telephone density of around 85 %. However, only 50% of subscribers have a mobile internet connection out of these. This leaves the 3G/4G penetration figures at 48 percent.

The Asaan Mobile Account will especially help low income segments with non-digital phones and no access to the internet to enjoy banking. It offers a much simpler process, like dialing a code, to avail common financial services.

It is also a very effective platform to bring Pakistani women customer segments into the banking sphere since they face greater obstacles in accessing formal financial services due to mobility, cultural, and documentation issues.

AMA has been launched with the support of various key stakeholders, including the Pakistan Telecommunication Authority, National Database and Registration Authority, multiple branchless banking providers, including both banks and microfinance banks, cellular mobile operators (CMOs), and virtual remittance gateway (VRG).

VRG has been licensed jointly by SBP and PTA under regulations for mobile banking interoperability.

Sadia Zaheer holds a Masters in Business Administration from IBA, Karachi. After working in several financial institutions in Client Management, Corporate Lending, Islamic Banking and Product Management she jumped careers to pursue a career in writing.

She is a Finance, Business and HR Development writer with four years of experience. She reads a lot and takes care of her multiple cats to remain calm.